Home Insurance

Protect your investment with the right insurance coverage.

Insurance

Best Homeowners Insurance in 2025

Insurance

The Growing Need for Squatter Insurance

Insurance

What Is Gap Insurance?

Insurance

Best Earthquake Insurance in 2025

Insurance

ASPCA Pet Insurance Review

Insurance

Best Title Insurance Companies in 2025

Insurance

How To Get Cheap Car Insurance in 2025

Insurance

GEICO Umbrella Insurance - 2025 Guide

Insurance

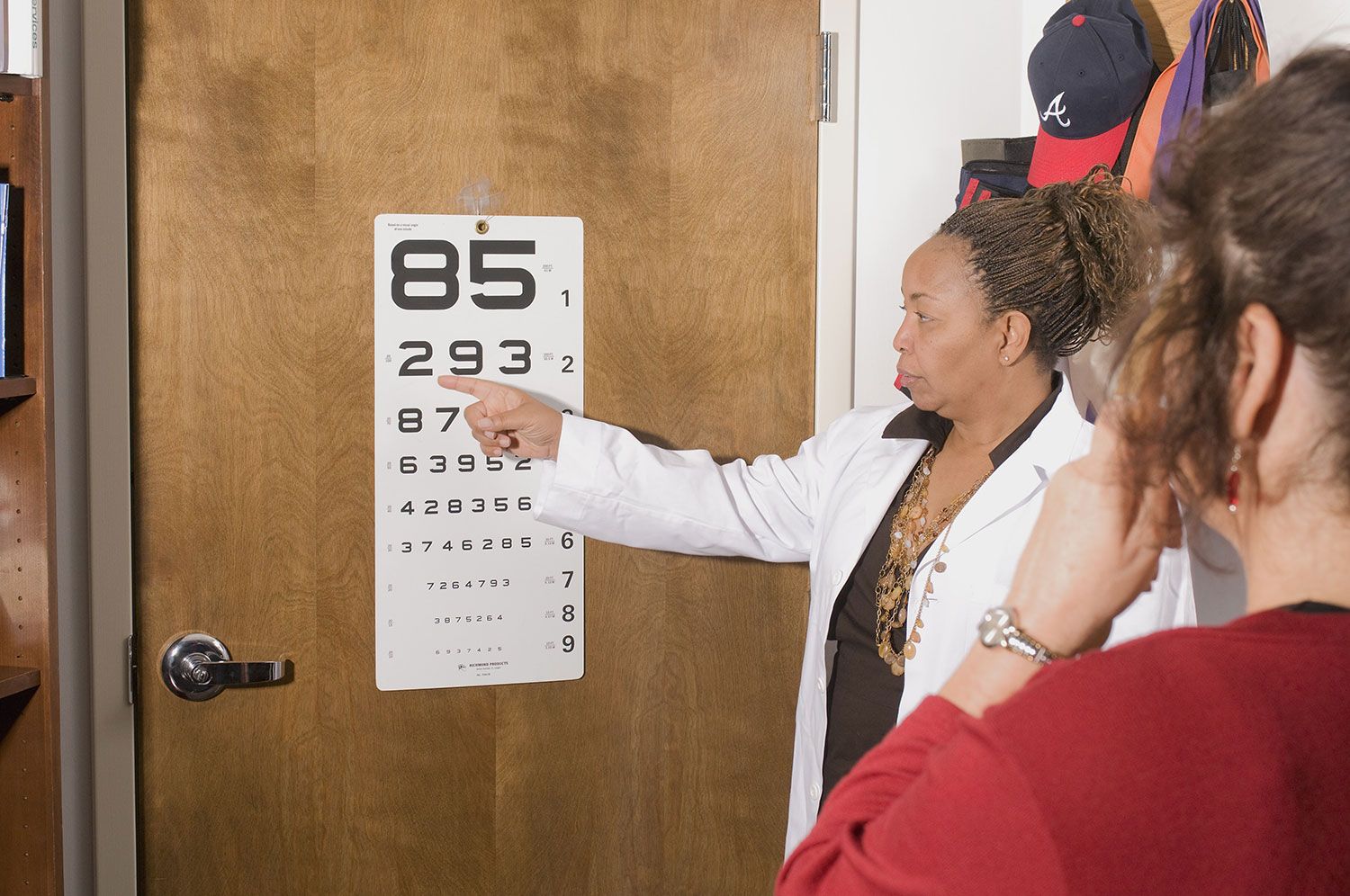

Best Vision Insurance Companies in 2025

Insurance

What Is Mortgage Insurance?

Insurance

Best Dental Insurance in 2025

Insurance

Pets Best Insurance - 2025 Review

Insurance

Best Travel Insurance Companies in 2025

Insurance

Best Life Insurance Companies in 2025

Insurance

Best Long Term Care Insurance in 2025

Insurance

Best Pet Insurance Companies in 2025

Insurance

Best Health Insurance Companies in 2025

Insurance

Best Identity Theft Insurance in 2025

Insurance

What Type of Life Insurance Do I Need?

Insurance

USAA Home Insurance - 2025 Review

Insurance

Erie Home Insurance - 2025 Review

Insurance

Amica Home Insurance - 2025 Review

Insurance

Progressive Home Insurance - 2025 Review

Insurance

Best Car Insurance Discounts in 2025

Insurance

Homeowners Guide To Disability Insurance

Insurance

Insurance Guide