Lemonade Home Insurance - 2025 Homeowners Guide

Based in New York City, Lemonade Home Insurance is primarily an online company providing a unique digital homeowner’s insurance experience. Since 2015, Lemonade has offered several types of insurance coverage products, including Lemonade renter’s insurance, pet insurance, car insurance, and homeowner’s insurance.

Although Lemonade’s insurances are available across all of the United States and in other countries like Germany and France, its homeowner’s insurance is only available in 23 states, leaving out states like Alabama, California, Maine, and South Carolina.

Lemonade Home Insurance: Company Overview

Lemonade home insurance is unique from traditional insurance companies in that it provides a more digitized experience than others. For many customers, this is a plus. You can visit the website, get an online quote, and sign up for insurance through the online system, all within a matter of minutes. Lemonade’s online account also makes it easy for homeowners to check their insurance policies, file claims, and track their claims.

👍

Pros

- Easy digital signup process

- Competitive pricing

- High coverage limits

- Very fast claims process

👎

Cons

- Only available in 23 states

- Can be challenging to talk to a person when needed

The downside of that digitized process is that speaking with a human Lemonade representative can prove to be difficult. Signing up over the phone isn’t possible – it must be done through the website. This may prevent potential Lemonade customers from getting their questions answered. Although a phone number is available, it’s not prominently displayed on the site, so customers need to dig a bit to find contact information.

As one of the best homeowners insurance companies, competitors of Lemonade include:

Lemonade Giveback

Lemonade seeks to transform insurance into a “social good.” Unlike other companies, Lemonade doesn’t pocket all of its profits. Instead, the company has a program known as Lemonade Giveback, which provides charities with a portion of its profits each year.

Lemonade invites its customers to select the nonprofit organization they’d like to donate to when they sign up. Then, Lemonade donates up to 40% of unclaimed funds from all customers who choose the same charity.

Types of Coverage Available

Lemonade offers various types of coverage for homeowners. Whether you want affordable coverage or want to make sure every part of your home is completely covered, Lemonade has the right coverage for you.

What Lemonade Homeowner’s Insurance Covers

Lemonade home insurance coverages vary by policy. However, its coverage includes the standard protections you’d expect in a homeowner’s insurance policy, including:

- Dwelling coverage: This coverage protects the actual structure of your home in the event of damage caused by a covered peril. In other words, damage to a lived-in area of your home is usually covered.

- Personal property coverage: When a covered peril damages your personal property, this insurance coverage can help reimburse you for the value of your damaged items.

- Personal liability coverage: Personal liability insurance provides coverage when you’re at fault, in some way, for someone else’s injury or property damage.

- Loss of use coverage: If damage from a covered peril causes you to have to leave your home and find other temporary housing, loss of use coverage can give you money to pay for that temporary housing and other living expenses, like laundromat visits and food bills.

- Other structures coverage: This is for parts of your property that are not attached to the main home, like a shed, fencing, or detached garage.

- Medical payments coverage: If a guest gets injured on your property, this insurance coverage can kick in to help pay for some of their medical bills.

What Are Named Perils?

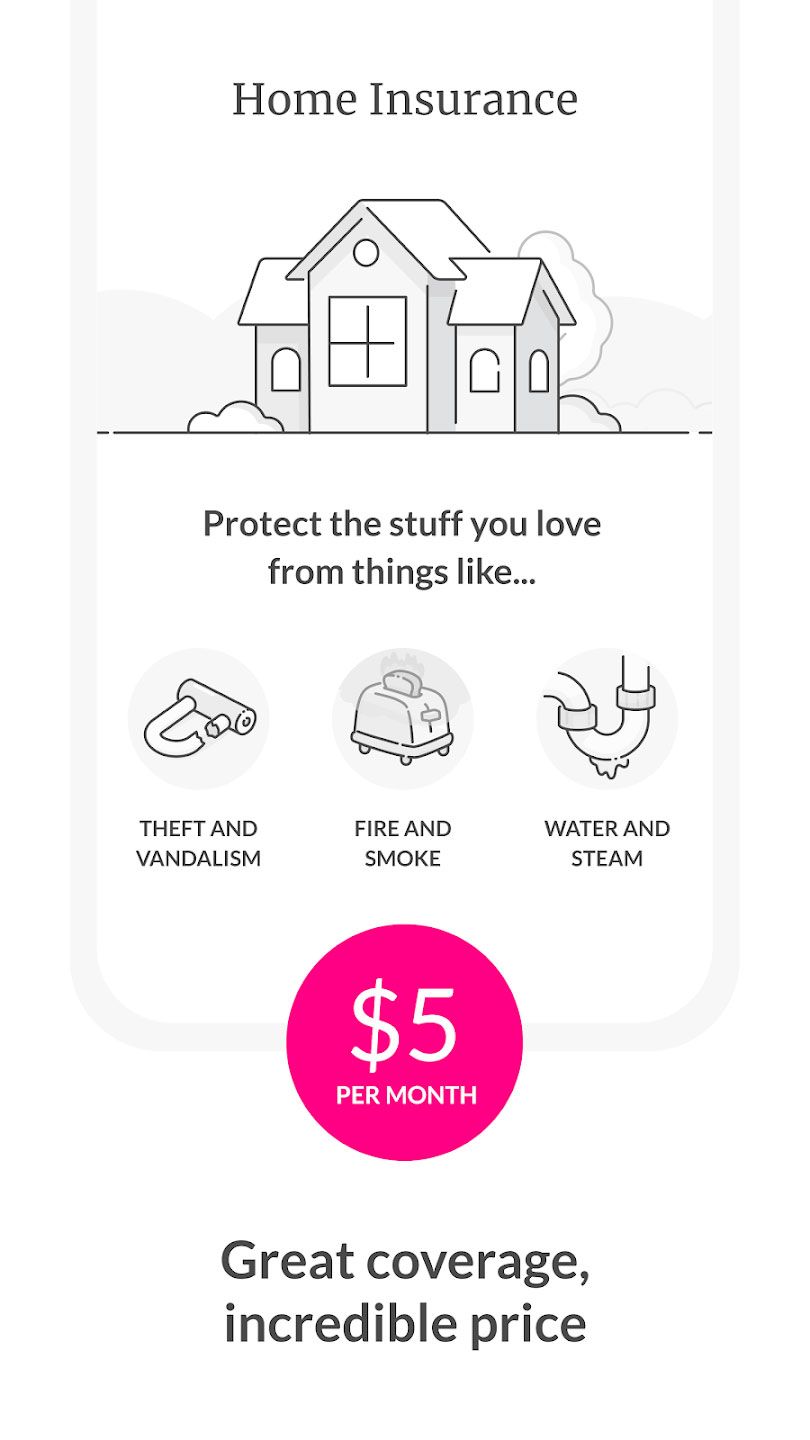

A named peril is a term used in the home insurance industry to refer to any specific event or occurrence that is included in your policy. Named perils may damage your home’s structure or personal property, causing you to file a claim through your Lemonade home insurance policy. Examples of named perils include theft, vandalism, fire, smoke, ice, vehicle damage, and falling objects.

Any event that isn’t listed as a named peril may not be eligible for coverage under your homeowner’s insurance policy, depending on the type of policy you have.

Types of Lemonade Home Insurance Policies

Lemonade home insurance offers eight different types of homeowner’s insurance policies, which vary in the types of homes and the amount of coverage they provide.

H-01 Policy

H-01 is the most basic coverage for traditional homes, extending protection to more common named perils, such as fire, theft or vandalism, and smoke. However, damage resulting from freezing, short circuiting, and falling objects won’t be covered under this type of insurance.

While coverages are reduced with an H-01 policy, homeowners can typically expect to pay lower premiums. If affordability is a primary concern, an H-01 policy is often the best choice.

H-02 Policy

H-02 policies provide extended protection for more named perils than an H-01 policy. Rather than 10 named perils, H-02 policies allow coverage for 16 named perils, including falling objects and freezing. As you might expect, a homeowner will typically pay a bit higher premiums for an H-02 policy compared to an H-01 policy to get coverage for these named perils. Otherwise, the two types of insurance policies don’t differ much.

H-03 Policy

An H-03 policy is what most U.S. homeowners have. In fact, this type of policy is sometimes the minimum coverage required by lenders financing mortgages. That’s because it offers much higher protection compared to an H-01 or H-02 policy.

While H-01 and H-02 policies only cover named perils, H-03 policies are more open-ended. With this type of policy, your coverage may extend to virtually any event causing damage to your home except for those specifically excluded from the policy. Additionally, H-03 policies include personal property, liability, medical fees, other structures, and loss of use coverage, which you won’t find on lower-coverage homeowner’s insurance policies.

H-05 Policy

Lemonade home insurance also allows homeowners to choose H-05 policies, which are basically more comprehensive versions of an H-03 policy. H-05 insurance generally has higher premiums than H-03 insurance, but with those higher premiums, you typically get higher coverage limits for dwelling, personal liability, personal property, and other insurances included in your policy.

One reason some homeowners prefer H-05 over H-03 coverage is that H-05 covers personal property for virtually any reason other than specifically excluded perils. Lemonade’s H-05 coverage also provides replacement cost value rather than H-03’s actual cash value for your personal items, which can give you more money to replace your belongings in the event of damage to your property.

H-06 Policy

H-06 policies are strictly for condo owners. These policies differ from traditional homeowner’s insurance policies in that they cover a condo’s structure and homeowner’s personal property, which fall outside of the Homeowner’s Association’s (HOA) insurance coverage. Condo owners can have anything inside of their condo covered and get the same protections traditional homeowner’s insurance provides, such as loss of use and personal liability coverage.

H-08 Policy

H-08 insurance policies are reserved for old homes. Lemonade home insurance includes 11 covered perils in these policies, such as fire, theft, and smoke. Homes covered under an H-08 policy are covered at actual cash value rather than replacement cost. However, it’s possible for homeowners who complete massive renovations to an older home to switch from an H-08 policy to another policy after finishing their renovations that bring the home up to modern code.

Extra Coverage

Lemonade homeowner’s insurance refers to its scheduled personal property coverage as “extra coverage.” This protection is specifically for high-value items that your regular policy may not cover.

For example, suppose you have a collection of antique silverware that’s worth thousands of dollars. In that case, you might want extra coverage to replace its value should your collection become damaged in a covered peril. With extra coverage (also known as scheduling), you can add that collection of silverware to your policy to ensure that your insurance includes it when paying out a claim.

As an additional bonus, you won’t have to pay a deductible on any claims for your scheduled personal property.

Dog Bite Coverage

Your Lemonade insurance policy protects you if your dog bites another dog or person, even if it happens outside of your home. You don’t need additional coverage for this, as your homeowner’s insurance can help pay for medical or vet bills resulting from the bite.

However, some dog breeds are excluded from being covered, depending on the governing laws in specific states. If you own one of the following breeds and live in a state that allows for these exclusions, your dog may be excluded from your policy:

- Akita

- Alaskan Malamute

- Chow

- Doberman Pinscher

- German Shepherd

- Great Dane

- Pit Bull

- Presa Canario

- Rottweiler

- Siberian Husky

- Staffordshire Terrier

- Wolf Hybrid

Additionally, Lemonade may exclude your dog if it has a known history of biting other dogs or people.

Lemonade Homeowner’s Insurance Add-Ons

Every home is different, and homeowners can have a variety of coverage needs. That’s why Lemonade home insurance provides a few add-on coverages to customize insurance policies.

Homeowners can choose from the following Lemonade Home Insurance add-ons:

- Foundation water damage/water backup coverage: Water backup coverage protects against damage resulting from water backups, like what might occur if your sump pump fails. Foundation water damage specifically protects your home’s foundation against water leaks.

- Buried utility coverage: This extra coverage protects underground utility lines running to your home, like water or sewer lines.

- Equipment breakdown coverage: This add-on allows extra protection for appliances and electronic equipment that become damaged due to an electric or mechanical failure.

- Swimming pool coverage: Lemonade home insurance policies only cover swimming pools if you add this coverage, which not only protects against damage to your pool but also provides coverage if someone were to get injured when using your pool.

- Extended reconstruction: If rebuilding your home due to a covered peril is costlier than originally expected, this coverage can add extra cash for repairs and reconstruction.

Pricing and Costs

The average cost of homeowner’s insurance is around $1,600 per year, for reference, but you’ll need a quote from Lemonade to get your specific pricing.

Lemonade home insurance pricing varies significantly between homeowners, as states, home values, and other factors each affect the price of home insurance. For instance, a $500,000 home will generally have higher home insurance premiums than a $100,000 home in a similar area. Similarly, a home in Colorado will likely have higher premiums for home insurance than a same-value home in New York or Illinois, as Colorado has among the highest premiums in the nation.

Your premium may also rise or lower from the average for your location and home value, depending on the amount of your deductible and extra coverage, if any, you add to your homeowner’s insurance policy.

Lemonade also has bundling discounts, allowing you to purchase two or more policies through the company at discounted prices. Currently, the bundling discount is available when you bundle home insurance with pet, renters, car, or life insurance policies through Lemonade.

You can also adjust your deductible to lower your pricing. Generally, the higher your deductible, the lower your premium will be. Just remember to set your deductible to a price you can reasonably afford, as you’re responsible for paying the full amount before your insurance coverage pays.

Get a quote from Lemonade today!

How To Get a Quote

Lemonade offers quotes via its mobile app or website. To start your quote, download the app or visit lemonade.com/homeowners. Lemonade will ask you several questions about your home to provide the most accurate quote possible.

Lemonade Mobile App

The Lemonade mobile app is available for Android and iPhone users. If you’re not yet a Lemonade customer, you can use the app to receive a quote for home insurance, term life insurance, or another Lemonade insurance product. Once you’re a policyholder, the app gives you access to your online account to review your documents, pay bills, and file claims.

How To File a Claim

Lemonade ensures quick and convenient claims processing by using AI (artificial intelligence) to help move claims along in the system faster. You can submit a claim by logging into your Lemonade account via the Lemonade mobile app or website. Once there, tap the “File a Claim” button, answer the questions and describe the problem, and submit the claim. Depending on the type of claim, it may be approved instantly.

Customer Service Contact Info

Phone: 844-733-8666

Lemonade home insurance tries to keep everything as simple as possible for its customers by automating everything from your Lemonade policy quote to the customer service process. However, there may be times when speaking to a human is necessary, such as if you have a question or need to provide more information than the online quote process allows.

For these situations, customers can call Lemonade at (844) 733-8666 during weekdays from 9 am to 8 pm EST or email help@lemonade.com.

How To Cancel

Lemonade home insurance makes it easy to cancel your policy if you decide it’s not the right fit. To cancel, visit the Lemonade website or mobile app and log into your account. Then, find your policy in your account and find the “Cancel” link. Your policy can cancel immediately, as you aren’t locked into a contract with Lemonade.

However, be sure to have another policy lined up so you don’t go with any lapse in coverage. Not only can insurance gaps be unsafe for your home, but your mortgage lender may also charge penalty fees or begin foreclosure if you don’t have the required coverage.

30+ Ways To Save Money At Home.

Is Lemonade Homeowners Insurance Right for Me?

Lemonade home insurance has some unique traits that set it apart in the insurance industry. For starters, homeowners can have a portion of their premiums paid into a charity of their choice, with the company donating more than $6 million over the past several years.

Homeowners can also benefit from quick claims processes, and claims are often processed instantly. Your digitized policy is easy to access and modify if needed.

While Lemonade does have a phone number and email for customers to contact, these contact methods are not typically as responsive as other companies’ customer service departments.

Don’t forget that you can save costs by bundling Lemonade insurance products, like auto insurance or life insurance, or if you qualify for another Lemonade discount. If you’re considering Lemonade homeowner’s insurance, we suggest getting a quote from the website or app. It takes just a few minutes, so you can quickly compare Lemonade’s pricing with quotes from other companies.