Amica Home Insurance - 2025 Review

Amica launched in 1907, writing auto insurance policies in the United States. Since then, the company has expanded to include numerous types of insurance, including life insurance, flood insurance, and business property insurance. Amica home insurance first began in 1956, offering new and current homeowners dwelling replacement coverage, liability coverage, and numerous other standard and optional coverages to protect their homes and belongings.

Amica Insurance has a few subsidiaries that write its policies, including Amica General Agency, LLC and Amica Property and Casualty Insurance Company. Currently, Amica has over 1.4 million policies.

Amica Home Insurance: Company Overview

Amica is one of the country’s most well-known homeowner’s insurance companies. Policyholders can expect excellent and quick customer service and a bank of knowledge on the company’s website, which is easy to navigate and find the information you need without digging.

👍

Pros

- A+ BBB rating (accredited since 1957)

- Website transparency with coverage options

- Customizable plans

- Several homeowner’s insurance policy discounts

👎

Cons

- Online quoting process can be relatively lengthy

- Not available in Alaska and Hawaii

Unfortunately, homeowners in Alaska and Hawaii cannot get coverage through Amica, but the company is available in all other states for homeowner’s insurance. While overall reviews for Amica are positive, the online quoting process can be a drawback for some. The process asks several questions, some of which homeowners may not know the answers. This can make the process more difficult compared to online quotes from competitors.

On the plus side, the quote process can lead to more accurate results than others. If you find yourself needing help completing an online quote for Amica home insurance, you can call a representative instead.

As one of the best homeowners insurance companies, competitors of Amica include:

- Farmers Insurance

- Liberty Mutual

- American Family

- Progressive

- Lemonade

- Allstate

- State Farm

- Erie Insurance

- USAA

Types of Coverage Available

Amica streamlines the homeowner’s insurance process by bundling its homeowners insurance into two primary plans: Standard Choice Home Coverage and Platinum Choice Home Coverage. Both plans include the standard coverages you’d expect, like dwelling coverage and personal property coverage, but they offer varying levels of coverage, which will influence policyholders’ premiums.

Amica also provides homeowners with several additional insurance coverages, which we detail below.

Standard Choice Home Coverage

Amica’s Standard Choice Home Coverage is the type of policy many homeowners choose if they are looking for modest coverage limits and affordable insurance premiums. Standard Choice is an H-03 policy, which is considered a basic homeowner’s policy that includes required coverages, but often with lower coverage limits for dwelling or personal property coverage than other policies.

The Standard Choice Home Coverage plan from Amica includes coverage for your dwelling, non-attached structures, personal property, liability, and loss of use. However, the standard dwelling coverage only includes actual value replacement rather than replacement cost coverage. The latter is usually the best option for homeowners seeking the highest coverage limits in the event of a covered peril damaging their home.

Additional Options for Standard Choice Home Coverage

If you choose a Standard Choice Home Coverage policy through Amica, you don’t need to settle for all of the standard coverages the plan includes. Instead, you can customize specific coverages to help you protect what matters most. If you believe extended coverage in all areas would be beneficial for your home, you can upgrade to the Platinum Choice Home Coverage policy.

A Standard Choice Home Coverage plan can be upgraded with optional add-ons, like water backup and sump pump overflow coverage or special computer coverage. You can also extend your personal property coverage to include full replacement coverage for your covered items.

Platinum Choice Home Coverage

Platinum Choice Home Coverage through Amica is a step up from Standard Choice Home Coverage. It includes everything in the standard plan but increases specific coverages, like liability coverage and personal property, for increased protection. This plan is an H-05 insurance policy, which offers some of the best protection for most homeowners, albeit with higher premiums than an H-03 policy.

Amica’s Platinum Choice Home Coverage includes dwelling replacement coverage as standard protection, giving homeowners an extra 30% to replace their home if needed. Other coverages that come with this extensive policy include up to $5,000 in credit card coverage for fraudulent usage, up to $5,000 toward medical payments, and water backup and sump pump overflow protection.

Although this plan includes enough coverage for most homeowners, it’s not as customizable as the Standard Choice Home Coverage policy. However, you can get a quote for both insurance policies when you quote with Amica home insurance to get an accurate comparison of features and pricing.

Amica Home Insurance: Additional Coverage Options

Homeowners can opt for numerous additional insurance coverages through Amica home insurance to get the right amount of protection for their specific needs.

Identity Theft Insurance

Identity theft insurance does not need to be added to an Amica homeowner’s insurance policy, but it could be a good idea to protect your assets even further. This coverage can shield you from legal fees, wage loss, and other potential monetary losses that can result from someone fraudulently accessing your bank accounts or opening a new account in your name. This insurance gives you up to $15,000 to help you navigate identity theft.

Earthquake and Flood Insurance

In some areas, flood insurance is mandatory for homeowners. Through Amica and underwritten by the National Flood Insurance Program, flood insurance can offer a total of up to $350,000 to protect your home and personal belongings from flood-related damage. Amica can also provide protection from earthquake damage from earthquake insurance, which is also required in earthquake-prone areas.

Special Computer Coverage

Special computer coverage can shield computers and other home electronics, like smartphones and smart TVs, from power surges, water damage, and other covered perils that can render them no longer usable. This optional coverage is one to consider if you have multiple electronic items that you use frequently and can be costly to replace, and you’re not sure if your personal property coverage will be enough to cover them and your other belongings.

Scheduled Personal Property Coverage

While homeowner’s insurance policies come standard with personal property coverage, they may not offer enough money for a claim to cover all of a person’s or family’s belongings. If you have expensive items, like trading card collections, antiques, or jewelry, you might consider adding scheduled personal property coverage through Amica. It adds covered perils for these items and provides extra coverage for your named items.

Coverage for Water Backup

When water backs up into your home due to a sump pump failure or a plumbing issue, it can cause a surprising amount of damage to floors, walls, and your personal belongings. This coverage can provide money to address these issues that aren’t caused by an event already included in your standard home insurance plan.

Dividend Policies

Amica offers homeowners in eligible states the choice between a traditional homeowner’s insurance policy and a dividend policy. With a dividend policy, a homeowner may receive a percentage of their policy back, up to 20%. These policies usually have higher overall premiums, but they also can save homeowners money on the lifetime of their policies.

Amica can offer dividend policies because it’s a mutual insurance company. Mutual insurance companies have policyholders that are shareholders in the company. Therefore, dividend policyholders can get back a portion of their share in the company in the form of a dividend on their policy.

Homeowners that receive a payment from their dividend policy can choose to receive a mailed check for their payment or apply it to their insurance premiums.

Home Business Coverage

Some homeowners run businesses from their homes, making home business coverage necessary in addition to traditional homeowner’s insurance.

Home business coverage can protect the homeowner in the event of a customer injury or other type of liability that happens during the course of business in the home. It also covers business equipment used in the home for business, like printing machines, salon equipment, computers, or inventory.

Pricing for home business coverage can vary significantly, depending on the type of business and activities conducted in the home. Amica’s agents can help you determine the amount of additional coverage for home business protection you should have.

Pricing and Costs

On average, an Amica policy is about $150 per month or around $1,800 per year.

Amica home insurance costs will vary based on a homeowner’s location, the size of the home, the year the home was built, how much the home will cost to replace, and several other factors. Some states have much higher home insurance costs than others, which is why obtaining a quote from Amica is the best way to learn how much you can expect to pay for your home insurance.

Data from several sources in the home insurance industry show that the average Amica home insurance policy is a little costlier than many of the company’s competitors, such as Progressive, Liberty Mutual, and American Family.

However, remember that you can adjust your costs by tweaking coverages for your home. Amica also offers several discounts to help you lower your premiums, including discounts for bundling your home with Amica life policies or other insurance products and using autopay to pay your bill. Raising your deductible and adding upgrades or safety features to your home can also lower your premiums.

Be sure to compare quotes for home insurance on a regular basis. Although one policy might be the most affordable one for your home for a couple of years, a policy from another company could become more affordable in the future. It’s a good idea to review your policy annually and get quotes from multiple companies to ensure the best price and coverage for your home.

Discounts

Amica home insurance provides policyholders with the opportunity to lower their premiums with various discounts, including:

Bundled policies

Homeowners who have other insurance policies through Amica Mutual Insurance, like car insurance or life insurance, can save money by bundling their policies with their home insurance. This discount can offer up to 30% off the cost of all policies.

E-policy discount

Policyholders who forego paper statements and other communications for emails and digital policy documents can get a discount on their policy.

Autopay

Let Amica take care of automatically withdrawing your homeowner’s insurance payments to save yourself time and get a policy discount.

Safety discounts

Homes with security systems, safety alarms, and other forms of safety and security may be eligible for policy discounts.

Loyalty savings

Homeowners who have had a policy with one company for at least two years before switching over to Amica may qualify for a loyalty discount.

Claim-free discount

Home insurance companies like to see homeowners without a costly claims history. If you come to Amica home insurance and have not had any claims on your previous policy within the last three years, you could qualify for a claim-free discount.

Other discounts may be available for your insurance policy. The best way to learn what savings you might qualify for is to speak with an Amica home insurance agent to get a home insurance quote.

How To Get an Amica Home Insurance Quote

Amica has an online home insurance quoting process that can show you estimated pricing for homeowner’s insurance in just a few minutes. Answer questions about yourself and your home to receive a quote online. You can either get a quote just for your home or a quote for bundled coverage if you plan to add your vehicle, life insurance, or other insurance products to Amica as well.

Some homeowners prefer to speak with someone to get a quote if they have questions or find the process confusing. In that case, you can call 800-242-6422 to speak with a sales representative who can guide you through the process and help you understand how Amica home insurance works and the coverages available.

How to File a Claim

Amica lets homeowners file claims via the online system, through the mobile app, through an online chat, or by phone. You can reach the online system or online chat by logging into your Amica home insurance account and clicking the button to file a claim or the live chat button at the bottom of the screen.

To file a claim by phone, customers can call 800-242-6422.

Once a claim is filed, you can check your online account or use your mobile advice to check on a claim. The online claims service allows you to upload documents, send photos of damage, and message Amica with any other information about your claim.

Customer Service Contact Info

Homeowners can contact Amica by phone at 800-242-6422 for claims, quotes, and questions. The claims line is available 24/7, while representatives are available for quotes and questions on weekdays from 7 am to 11 pm EST and weekdays from 8 am to 8 pm EST.

Customers can also use the live chat feature at the bottom of Amica’s website to contact a representative between 8 am and 9 pm EST on weekdays and Saturdays from 10 am to 5:30 pm EST. Messaging is also available through a customer’s online account, or website visitors can use the online form for questions that don’t need to be answered right away.

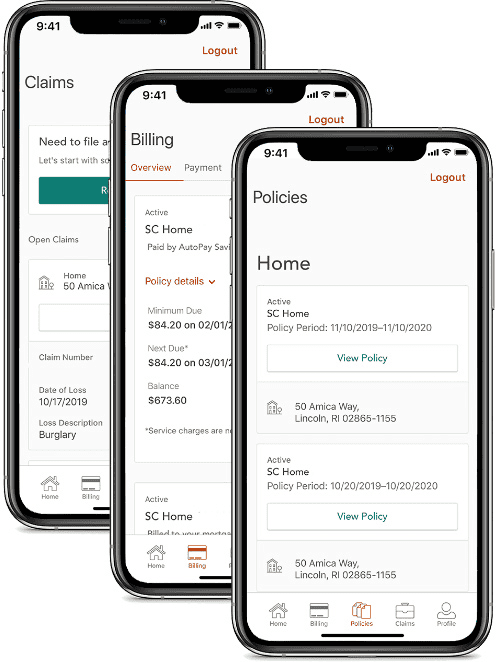

Amica Mobile App

Available on the Apple App Store and Google Play, Amica’s mobile app is designed to help Amica customers navigate their coverage and access Amica’s customer service as quickly as possible, even when they can’t get to a computer.

The mobile app shows account snapshots, lets you pay your premiums, provides online versions of your homeowner’s policy, and provides online claims servicing to file, update, and track claims.

Is Amica Homeowners Insurance Right for Me?

Most homeowners spend time searching for the best home insurance that fits their home and budget. Amica home insurance is an insurance company that might fit the bill for you, but taking the time to research coverage options and get a quote is the best way to know for sure.

Amica’s mobile app and multiple ways to contact customer service make it stand out among several competitors. Customers also like its customizable coverage and unique insurance products you can add to your policy, like identity theft insurance and special computer coverage.

To learn more about what Amica can offer you as a homeowner, complete the online quote process or call Amica to speak with a representative. Be sure to ask about any discounts you might qualify for, as well as additional options that help you get the best insurance coverage for your home and valuables.

We also suggest reaching out to other homeowner’s insurance companies for quotes, as premiums and coverages vary by company and by location. Although one company might have highly affordable coverage in one state, another company might offer better pricing for another state. Comparing quotes with similar coverages is the best way to ensure your coverage and costs make sense for you.