Best Earthquake Insurance in 2025

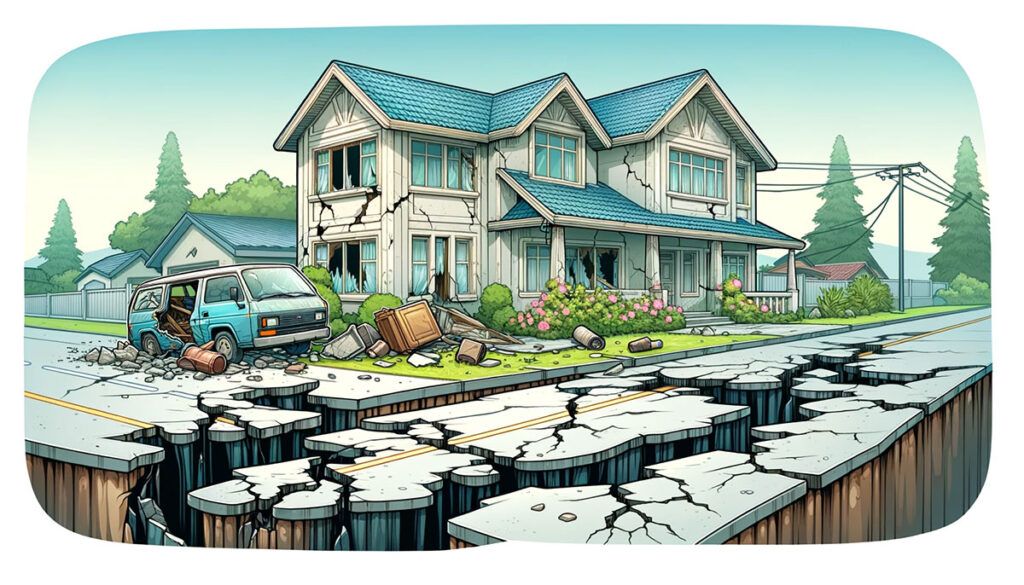

Depending on what part of the country you live in, you may decide that you want to boost your existing homeowner’s insurance policy and add additional protection from earthquakes. Not everyone will need or want this added security, but if you live in an earthquake-prone area, it can end up saving you thousands if not tens of thousands should your home suffer damage from an earthquake.

It’s important to understand how earthquake insurance works, how much you can expect to pay on average for your premium, and what kind of coverage options are available.

5 Best Earthquake Insurance Companies in the U.S.

Earthquake insurance is not automatically included in a standard homeowner policy, though your agent should inform you of your options to add it. This is especially true if you’re living someplace with a higher risk of earthquakes like the West Coast, Alaska, Hawaii, or areas of the Midwest. For example, in California, insurers are legally required to offer earthquake insurance either through their own company or through a third party.

While many major insurance companies will have some sort of earthquake policy or earthquake endorsement, other insurance providers specialize in natural disaster coverage. These types of insurance companies may be able to offer the most options to customize an earthquake insurance policy that best fits your needs and budget.

What Is Earthquake Insurance?

Earthquake insurance is a specific type of coverage that provides financial compensation for damage caused by an earthquake. The exact scope of coverage will depend on your policy, but coverage typically includes damages to your home and personal property within the home. Earthquake insurance can also pay for living expenses if you’re displaced due to the quake.

Earthquake insurance coverage can be made available to homeowners, commercial property owners, and renters. However, renters insurance for earthquakes needs to be purchased separately from a standard renters insurance policy and typically only covers personal property.

5 Best Earthquake Insurance Companies in 2025

1. GeoVera

GeoVera sells earthquake policies in California, Oregon, and Washington. The company only focuses on catastrophic insurance coverage, making it an expert in the field. However, this will mean that you’ll have to find a homeowners policy through another insurance company which means you won’t get any bundling discounts. Furthermore, these policies are only available to homeowners at this time and the company currently doesn’t offer a renters insurance policy.

GeoVera stands out from its competitors with its easy-to-use website that allows you to get quotes online without having to speak with an agent and you can file claims online too. It also has some of the lowest deductible options in the industry with some even as low as 2.5% though these will come with a significantly higher monthly premium. Those looking for a lower average premium can find plans with a 10% to 25% deductible depending on the amount of dwelling coverage they choose.

2. California Earthquake Authority

The California Earthquake Authority (CEA) is unique among insurers because it’s a publicly managed agency yet it’s funded privately. In fact, it’s technically not an insurance company at all, nor is it considered a government agency.

The company was first established in 1996 in response to the 1994 Northridge earthquake that caused over $26 billion in losses making it clear that more coverage was needed for Californians. As a result of the extreme earthquake damage, insurance providers across the state severely reduced the number of homeowner policies they offered, and several stopped offering them altogether. As an emergency measure, the CEA was formed, and today it accounts for over 66% of the total earthquake policies sold in the state to over one million households.

The CEA works by partnering with 25 different insurance providers in the state to offer homeowners, condo owners, those in manufactured homes, and renters access to this additional coverage. However, individuals cannot purchase a policy directly from the CEA. Instead, they must go through a private company. No matter what insurer you go with, you’ll be offered the same plans and rates and the CEA works with big names like Allstate, Amica, Farmers, Liberty Mutual, USAA, Progressive, and State Farm.

CEA earthquake insurance will cover damage to your dwelling, personal property, and additional living expenses, although you can choose which of these coverage options you want. For example, you could choose a policy that only includes dwelling coverage. Deductibles start at 5% and increase in 5% increments up to 25%. On average, the premiums offered by the CEA are slightly lower than their private market competitors, but this depends on what kind of coverage you choose.

The organization also has educational outreach programs intended to teach Californians about the dangers of a major earthquake. The organization stresses the importance of keeping an insurance policy for these events, as well as taking preventative measures to reduce damage in the first place. For example, CEA currently offers Californians who own older homes a grant of up to $3,000 to retrofit their structures and strengthen their houses. It also partners with other governmental agencies like the Federal Emergency Management Agency (FEMA) to engage in research to mitigate the damage caused by earthquakes.

3. Amica

Amica partners with the CEA to offer earthquake coverage to its policyholders and allows you to bundle this additional policy with an existing auto insurance or home insurance policy.

Although Amica doesn’t have its own earthquake policy, it does offer other catastrophic plans like flood insurance and additional coverage for personal belongings and valuables. Amica will also still handle all claims even though the policy is provided by the CEA.

4. American Family

American Family Insurance has been in business for nearly 100 years and offers several bundling options for policyholders wishing to add on earthquake insurance.

American Family is a good choice for those who already have existing policies with the insurer. It currently offers earthquake insurance coverage in Arizona, Colorado, Idaho, Illinois, Indiana, Iowa, Missouri, Nevada, Oregon, Utah, and Washington. You can choose a policy that not only covers your home but also other structures and parts of your property such as sheds, garages, fences, sidewalks, or driveways.

If you want to obtain a quote from American Family you’ll have to speak with an agent as online quotes are not available at this time. You’ll also need to be prepared to give them detailed information about your home as several factors will affect your rate, such as the age of your house, the materials it’s built with, the height, and where it’s located.

5. Chubb

Chubb offers policies for natural disasters like earthquakes in addition to homeowners, auto, travel – even cyber liability insurance. They specialize in high-value residential and commercial property insurance and can therefore offer some of the highest coverage options in the industry. However, you’ll often have to pay a higher premium for this coverage.

What Does Earthquake Insurance Cover?

Most earthquake insurance policies cover three main expenses: dwelling, personal property, and additional living expenses.

Dwelling

The first category of coverage is for your dwelling (your home), which typically means you’ll be reimbursed the cost to rebuild your home after an earthquake, but it can also include external structures like garages, sheds, or sometimes swimming pools.

Property

The second category is personal property coverage which pays out the replacement cost for certain items that you keep in your home like furniture, clothing, or appliances though there will likely be limits on this such as an overall reimbursement cap or caps on certain items.

If you have valuables like artwork, jewelry, or family heirlooms that you’re concerned may not be included, it’s best to speak directly with your agent. In some cases, you may be able to “schedule” these items, meaning you’ll purchase additional coverage on your listed valuables.

Additional Living Expenses – Loss of Use Coverage

The last category that earthquake insurance covers is additional living expenses (ALE), which is also referred to as “loss of use” coverage. This covers expenses related to things you may need if you’re displaced from your home such as hotel rooms, food, or parking and storage fees.

Keep in mind that many earthquake policies will not cover certain damage that commonly occurs after an earthquake such as fires, sinkholes, vehicle damage, or floods.

How Much Does Earthquake Insurance Cost?

The actual cost of earthquake insurance coverage will vary widely and depends on a few factors. The average annual cost is typically around $800, but this can decrease or significantly increase based on your circumstances. The first factor in determining the cost is where in the country you live and whether you’re in a high-risk zone for earthquakes. States like California, Washington, and Missouri are considered in the highest risk category, but almost all the states in the country have at least some level of risk.

Other factors that will affect your cost are the age, condition, and value of your home. Older homes are typically built with older materials and haven’t been engineered with earthquakes in mind. Additionally, homes built of brick are more likely than a wood-frame house to collapse in an earthquake and this will likely increase your premium. Homes built on unstable ground or faulty foundations as well as multi-story homes will also cost more to insure because they’re more likely to sustain damage in an earthquake. The value of your home will also affect your insurance policy premium since expensive homes cost more to rebuild and this translates to a higher premium.

Is Earthquake Insurance Worth It?

In general, purchasing earthquake insurance is worth it if you’re in a higher-risk area, but there is no federal or state law requiring you to carry it. And, even though mortgage lenders require their borrowers to maintain a homeowners insurance policy, there is no such requirement for earthquake insurance. This is true even in the most earthquake-prone parts of the country like Missouri’s New Madrid area or the San Francisco Bay area. However, in California, insurance providers are required to offer it as an optional upgrade.

Premiums for earthquake insurance tend to be very high and this must be paid on top of your homeowner policy. It’s understandable why many homeowners and renters choose to forgo it. However, if you don’t have the funds to replace your possessions and rebuild your home, consider buying a policy if you’re in a high-risk area with seismic activity. Right now, 16 states in the U.S. are considered “high risk.” In short, like all types of insurance products from health insurance to car insurance, you’ll have to balance the risk versus the reward for yourself and determine the right amount of coverage for your home and property.