12 Best Flood Insurance Companies in 2025

There are many different types of insurance that can help protect you and your property. From health insurance and life to car insurance to homeowners insurance, insurance policies offer many different types of coverage. Though shopping for coverage can feel overwhelming at times, insurance serves an essential function to keep our bodies and possessions protected now and in the future. For homeowners, one type of insurance that’s often overlooked is flood insurance. Most homeowners insurance plans do not cover flood damage, so flood insurance must be purchased separately.

12 Best Flood Insurance Companies in 2025

| Flood Insurance Company | Coverage Highlights | Best For |

|---|---|---|

| CATcoverage.com | Higher limits, AI-driven pricing, NCIP exclusive features | Producers seeking advanced tools and commissions |

| Geico | Competitive premiums, discounts for bundling | Cost-conscious customers bundling policies |

| FloodPrice.com | Quick comparisons, private and NFIP policies | Fast, user-friendly quoting and variety |

| Allstate | Customizable plans, bundling discounts | Homeowners needing custom policies |

| Chubb | High-value coverage up to $15M, broad inclusions | High-value properties |

| USAA | Military-only, affordable with discounts | Military families and veterans |

| American Family | NFIP-based policies with standard provisions | Nationwide availability of standard coverage |

| Aon Edge | High limits up to $5M, unique riders | High limits and additional coverage options |

| Neptune Flood | Streamlined quotes, coverage for excluded items | Quick quotes, coverage for unique needs |

| Progressive | NFIP coverage with add-on options | Basic NFIP flood insurance |

| Farmers | Standard and preferred risk policies with riders | Standard or preferred risk areas |

| Liberty Mutual | NFIP plans through agents | Existing Liberty Mutual customers |

Depending on what part of the country you live in, you have a different level of risk for flooding. Therefore, not everyone will need (or want) to purchase flood coverage. However, even a seemingly small amount of water can produce devastating flood damage, and federal disaster assistance funds can only go so far. Like any home insurance policy, you’ll need to balance the risk versus the reward of paying for a policy that you may never need. It’s important to understand the basics of what flood insurance does and does not cover, what kind of property owners will likely benefit from it most, and what your options are when choosing an insurance company.

What Is Flood Insurance?

Flood insurance is a type of property insurance that covers water damage specifically due to a flood. Floods typically cause extreme damage and are often categorized as a natural disaster or “vis major,” which is a Latin term used in insurance contracts to describe damage caused by a natural occurrence like a hurricane, flood, or earthquake. This is in contrast to other forms of water damage that can occur in a home due to a burst pipe, leaky faucet, backed-up sewer, roof leak, or an older water heater. A burst pipe may be covered by a homeowners policy or home warranty, but flood damage is almost always excluded from homeowners insurance policies.

Flood insurance must be purchased separately. Insurance companies will only pay out in the event of water damage to their home from a flood – not other types of water damage. Importantly, this is different from regular homeowners insurance which also covers water damage but in a more limited context, typically only including internal damage like burst pipes.

Policyholders pay a monthly or yearly premium and in return get a cash reimbursement for the cost to repair or replace a damaged structure or damaged personal property. This type of coverage is often optional, but if you live in a high-risk area, your lender may require you to purchase a flood policy. Additionally, flood insurance may be purchased by a renter, but this policy would only include contents coverage, not structural.

What Is the National Flood Insurance Program (NFIP)?

The National Flood Insurance Program (NFIP) became federal law in 1968. The program is managed by the Federal Emergency Management Agency (FEMA). The program was started as a response to rising costs faced by Americans when they experienced flood loss and found that federal emergency assistance wasn’t enough. The goal of the program is to protect the financial loss suffered by the property owner (both business and residential) while also reducing the amount of future flood damage. Since its inception, the NFIP has provided flood insurance coverage to over five million policyholders across the country. The program is constantly being improved with new funding being added over the years as it responds to increased natural disasters such as Hurricane Hugo in 1989, Hurricane Katrina in 2005, and Hurricane Harvey in 2017.

The NFIP essentially works by providing federally-backed national flood insurance by partnering with more than 50 private insurers across the country. End consumers will still purchase a plan through a private company, but the NFIP regulates the cost and coverage limits of each policy. They set rates based on a number of factors including where you’re located, the condition of the structure you’re insuring, the type of flood zone, and how many other homes are insured in your area.

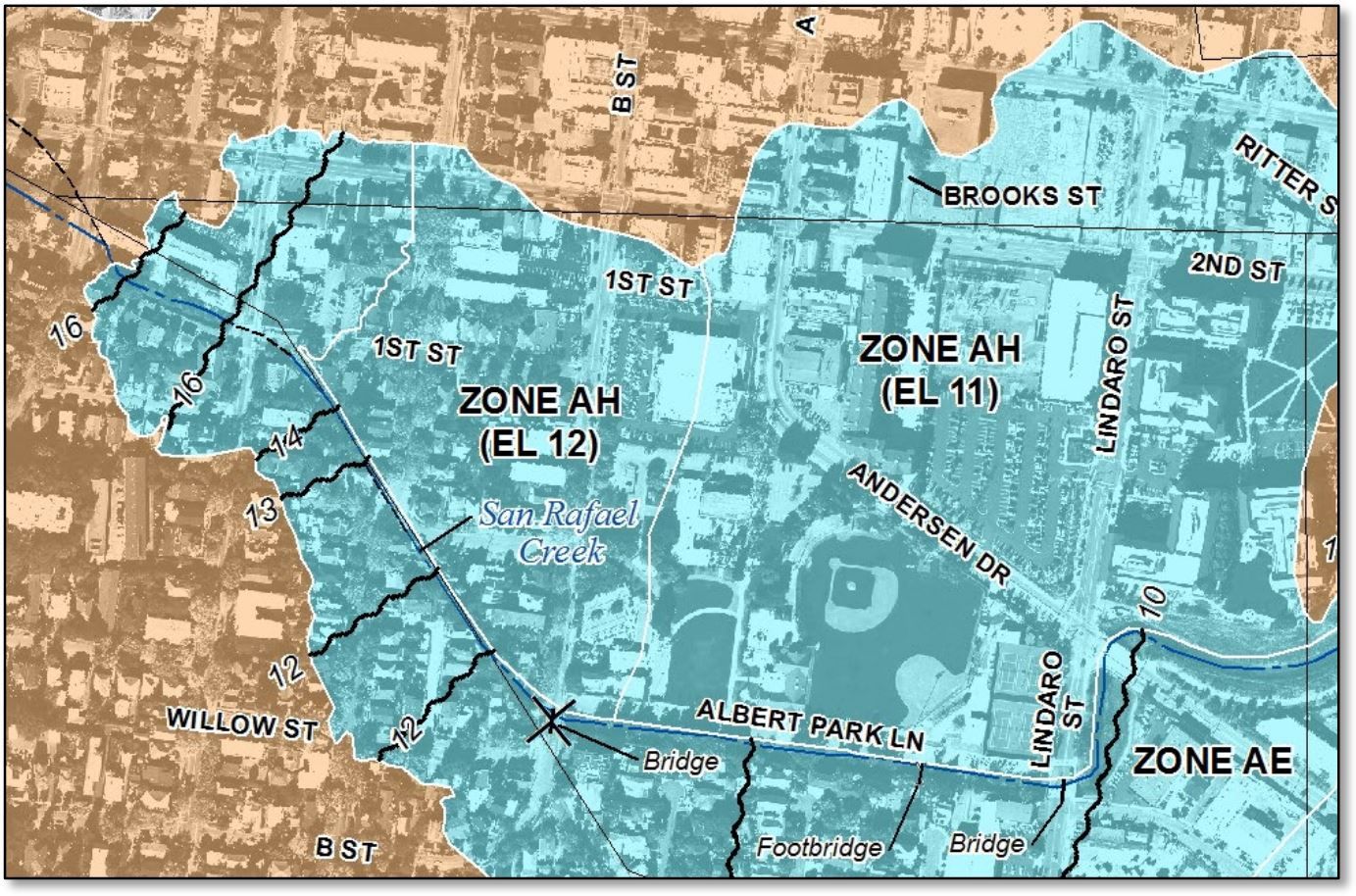

FEMA works with the NFIP to designate different flood zones in the country to determine your risk rating for flood damage. These are categorized as zones A, B, C, D, V, or X and within these are subcategories that further delineate the risk of flooding. Zones A and V are considered the highest-risk areas; zones B, C, and X and low to moderate risk; and, zone D indicates an area that hasn’t been assigned a risk factor yet. Each community that receives a designation must provide a Flood Insurance Rate Map (FIRM) that anyone may review to see if they’re in a low, medium, or high-risk zone.

12 Best Private Flood Insurance Companies in 2025

Top Rated: CATcoverage.com

Empowering Insurance Agents with Superior Solutions

In 2003, CATcoverage.com revolutionized the flood insurance industry by providing producers with the tools to expand their offerings and boost revenue. Agents partnering with CATcoverage.com can earn highly competitive commissions—15% on new flood policies and 12.5% on renewals—with one of the most lucrative programs in the market. Take advantage of their simplified, online quoting process and offer superior coverage options to your clients.

As the exclusive provider of the Natural Catastrophe Insurance Program (NCIP), CATcoverage sets a standard in flood insurance that exceeds the offering of the National Flood Insurance Program (NFIP). With options like higher coverage limits, shorter waiting periods, basement coverage, reimbursement for additional living expenses, and a broader definition of “flood”, producers have a competitive edge to attract and retain more customers, while meeting their unique needs with confidence.

CATcoverage.com uses AI-driven technology to calculate premiums based on an accurate assessment of risk exposure, rather than relying on outdated NFIP flood zone maps. This ensures more fair and accurate pricing tailored to each client’s unique needs.

By combining advanced technology, unparalleled benefits, and a producer-focused approach, CATcoverage.com is the go-to solution for producers looking to grow their business and provide exceptional value to their clients.

Geico

Geico is one of the largest insurance providers in the country and tends to have lower average premiums for flood insurance than its competitors. The company also offers discounts for bundling with other policies like home or auto.

Since Geico is so big, it has local agents all across the country which means you can speak with an insurance agent quickly to get a quote or file a flood claim. There are some restrictions on what’s covered, with most plans excluding carpets or personal property kept in a basement, and you won’t be able to qualify for coverage if your home sits on or partially on water (such as resting on stilts above a shoreline).

FloodPrice.com

Your Go-To Destination for Flood Insurance

FloodPrice.com revolutionizes flood insurance by offering a seamless, all-in-one platform that combines convenience, competitive pricing, and expert guidance. Whether you’re considering private flood insurance or policies through the National Flood Insurance Program (NFIP), FloodPrice.com makes finding the right coverage quick and hassle-free. In as little as five minutes, consumers can compare options and secure a policy tailored to their specific needs.

Gain access to top-rated flood insurance carriers, ensuring your property is protected with comprehensive and reliable coverage. The quoting platform leverages cutting-edge technology to search the marketplace for the best price and coverage options tailored to your needs. While FloodPrice offers both NFIP and private flood insurance solutions, private carriers have coverage options that go above and beyond NFIP limitations, such as finished basements, detached structures, temporary living expenses, and more!

Designed for simplicity and efficiency, FloodPrice.com combines an intuitive digital experience with unmatched customer service. Whether you prefer the convenience of obtaining a quote online or the personalized assistance of speaking with a flood expert, FloodPrice.com ensures you have the support you need every step of the way.

👉 Protect your property with confidence. Visit FloodPrice.com today to explore your options and secure the comprehensive coverage you deserve.

Allstate

Allstate gets high marks by offering their customers customizable flood insurance plans which means homeowners don’t have to settle for a one-size-fits-all policy.

Depending on your location, you may also be offered options that other companies aren’t able to provide such as coverage for lawn and garden damage as well as damage caused by a sewage backup. However, Allstate does tend to have higher premiums on average than its competitors, but these can be reduced when you bundle with an Allstate auto, home, or life insurance policy.

Chubb

For homeowners with high-value properties, Chubb will likely offer the most comprehensive coverage since it’s a private company and not bound to the NFIP conditions.

Chubb has some of the highest coverage limits in the industry, going as high as $15 million for structure and contents coverage, which greatly exceeds the required limit of $250,000 imposed by the NFIP. This coverage also includes many types of property left out by competing policies such as items stored in a basement, carpeting, and personal possessions. Accordingly, the monthly premiums for such coverage will be quite high, but your actual premium will depend on many factors.

USAA

The United Services Automobile Association (USAA) is an insurance provider that only offers policies to veterans, those who are currently in the United States Military, and their families. USAA has moved beyond only selling auto insurance and can provide flood coverage up to the NFIP limit of $250,000 for structures and up to $100,000 for personal property (and in some cases, you may be able to exceed this amount).

Getting insurance through USAA is a quick and affordable option for veterans and service members. Policyholders find they’re often offered premiums below the national average. Additionally, if a policyholder doesn’t file a flood insurance claim within a certain period of time, they may be eligible for discounts or rebates.

American Family

American Family has been providing multiple insurance options for nearly 100 years and it currently offers flood insurance in all 50 states.

The company’s flood policies can include coverage for dwelling units, personal property, carpeting, window coverings, electrical and plumbing, furniture, cabinetry, and HVAC systems. American Family partners with the federal government for its flood policies and follows all provisions set out by the NFIP.

Aon Edge

Aon Edge provides private flood insurance and differs from other providers because this is the only type of insurance it offers. Because of this, it’s able to extend high coverage options up to $5 million for structures and $875,000 for personal property through its plans like EZ Flood (its standard policy) and Excess Flood (its extended policy).

It also has riders available for swimming pools, spoiled food, and temporary living expenses for those displaced due to flooding. The policies are available in almost all states except Washington D.C., Hawaii, Alaska, and Kentucky.

Neptune Flood

Neptune Flood is another private flood insurance company that’s been offering policies in all states but Kentucky and Alaska since 2016. Neptune aims to serve customers through a streamlined quote system offered entirely online, and provides coverage that a traditional insurance company cannot such as damaged basements, swimming pools, detached structures like sheds and garages, and reimbursement for living expenses.

The company’s policies can cover as much as $4 million for structures and $500,000 for personal property.

Progressive

Progressive offers flood insurance through the NFIP with standard coverage amounts of up to $250,000 for structures and $100,000 for personal belongings. You can obtain a flood insurance quote from a Progressive agent and add flood protection to any existing homeowner policy.

Farmers

Farmers Insurance offers two basic flood insurance options: a standard risk and preferred risk policy. Its standard policy is best for those in a high-risk flood plain area, while its preferred risk policy is ideal for those in a low to moderate risk area. For a standard plan, Farmers uses the NFIP rates to determine monthly premiums and coverage rates, but those who choose a preferred plan may qualify for discounts of up to 25%. Farmers Insurance also offers riders to increase coverage for valuables such as artwork or jewelry.

Liberty Mutual

Liberty Mutual does not provide flood insurance directly, but instead offers access to plans through the NFIP and the WYO (Write Your Own) Program. Those with a current Liberty Mutual policy can contact their agent to learn more about obtaining flood insurance.

What Does Flood Insurance Cover?

The exact amount of flood coverage varies by plan type. When you file a claim, the damage must have been caused directly by a flood. Most policies will be separated into building coverage (structural) and contents coverage. A policy that includes building coverage will reimburse costs for most home systems and appliances like your HVAC, water heater, electrical system, fuel tank, water pump, stove, dishwasher, and refrigerator. It will also cover the cost to repair or replace basic home features like flooring, carpeting, cabinetry, foundations, staircases, window blinds, wall paneling, and detached garages.

Contents coverage can include a broad range of personal property in your home, such as the washer and dryer, microwave oven, portable air conditioning units, furniture, electronics, clothing, or valuables like artwork. A number of items won’t be covered by a flood insurance policy, such as cars, currency, paper documents, or property outside your home like a hot tub, swimming pool, deck, or shed. Policies that are backed by the NFIP will have relatively the same amount of coverage and restrictions, while those offered by private insurers will typically cover more items and payout at much higher rates.

How Much Does Flood Insurance Cost?

The cost of your insurance will vary depending on your flood risk and what kind of flood zone you live in. Other factors include the age and condition of your home, the elevation of your home, and the location of utilities within the home. Working through the NFIP, FEMA computes these factors and evaluates the relative risk of flooding in your area to determine the flood insurance cost for residents.

Coverage is highest in northeastern states like Connecticut, Rhode Island, Vermont, and Pennsylvania. Coverage is lowest in Southeastern states like Florida, Maryland, Louisiana, North Carolina, and Texas where a higher percentage of homeowners carry a flood policy.

In general, customers who live in areas that see more flooding on average will see a lower flood insurance rate than those who live in low-risk areas. This is because more homeowners pay into the policies, and also because the NFIP wants to promote flood coverage in these areas by keeping costs relatively low.

What Is a Flood Zone?

When you start shopping for flood insurance you’ll encounter the term, “flood zone” when getting quotes. Everyone lives in some kind of flood zone, and all this means is that FEMA has assigned a risk category (either low, moderate, or high) for a certain geographical area. FEMA puts out community flood maps that are regularly updated and labeled to indicate current flood zones.

Flood zones marked with an unshaded X or a C are in the lowest risk category. These are areas that average under a 0.2% chance of flooding each year (also referred to as a 500-year flood area) and are at a higher elevation making damage from floods less likely. Areas marked with a B or a shaded X are considered at moderate risk, meaning there’s between a 0.2% and 1.0% chance of flooding (or they’re located in a 100- to 500-year flood area).

The highest risk zones are labeled A and V and these are reserved for areas with a greater than 1.0% chance of flooding each year. This designation is also called the “base flood” level, or a 100-year flood area. Flood zones labeled A are further divided into several sub-categories based on the area’s elevation, location (whether it’s near a river or stream), or whether there are functioning levees in the area. Damaged levees or levees that are currently under construction are considered the highest risk until the repairs are completed. Areas with an A or V label are considered a Special Flood Hazard Area (SFHA). Flood Zone V refers solely to coastal areas while Zone D refers to areas where no flood analysis has yet been performed.

NFIP vs Private Flood Insurance

If you’re in the market for flood insurance, you’ll have two basic options: NFIP or private flood insurance. As described above, the National Flood Insurance Program (NFIP) is a federally-run program that partners with private insurers to offer consumers basic flood insurance protection. Pricing and coverage limits for these plans are based on FEMA’s analysis of the different flood zones across the country.

Conversely, you can also choose to purchase private flood insurance which is not obligated to stay within the federal coverage limits and can offer home and business owners more flexible coverage options. If you live in a high-risk zone and your area is inundated by a flood, you’ll likely receive some federal disaster assistance, but this often won’t cover all your expenses and many homeowners find it more reassuring to keep a policy specifically for floods. Both the NFIP and private options offer good protection, but you should understand the advantages and disadvantages of each before deciding which is best for you.

These policies are available in all 50 states and are offered by big-name insurers like Allstate, Geico, and Farmers – providers that many Americans already have a business relationship with and hold other insurance policies with. This can make it easier to obtain quotes and potentially save on premiums if your provider offers bundling discounts.

NFIP policies are limited to $250,000 in structural coverage and $100,000 for personal belongings. For most low to middle-income households, this coverage will be sufficient though not everything you own is included. If you have a higher value home or want to cover specific items, you may want to opt for a private policy. Private plans have no caps on coverage and can reach into the millions for structural coverage and hundreds of thousands for personal property.

NCIP Advantages

https://www.youtube.com/watch?v=iLB2HCa7Zvc

NCIP (National Catastrophe Insurance Program) is the first and largest private flood insurance program in the United States. Designed to compete with the NFIP, NCIP offers flexible coverage options that go beyond federal limits. Unlike NFIP policies, which cap structural coverage at $250,000, NCIP provides higher coverage amounts and includes items often excluded from federal policies, like basement contents and detached structures. Many homeowners also find NCIP policies more affordable, with competitive rates and tailored protection. This program supports property owners in managing their risks effectively while offering a private alternative to federally-backed flood insurance.

Most private plans offer more coverage options that aren’t available through the NFIP. For example, most NFIP policies will not cover damage to basements, personal items stored in basements, detached structures like garages or sheds, landscaping, swimming pools or hot tubs, or reimbursement for living accommodations if you’re displaced by flooding. In almost all cases, a private insurer will be able to cover these items. Although there are far more people who buy NFIP plans, private plans are becoming more and more popular and some can even be found at rates lower than those backed by the federal government.

How To Save on Flood Insurance

Not all homeowners will need to purchase flood insurance, but you may decide it’s worth the investment for your peace of mind, or your lender may require it as part of the terms of your mortgage. Either way, you’ll want to figure out how to best balance your monthly costs with the coverage you receive for it.

One way to lower the cost of flood insurance is to mitigate your personal risk by making modifications and upgrades to your property. Simple fixes like elevating your utilities so they’re less likely to be damaged in a flood can reduce your average rate, as well as installing flood openings in basements and crawl spaces. Larger ticket fixes like filling in your basement or elevating your entire house can also result in a lower premium.

If you can’t make physical changes to your property, you can reduce your premium by choosing a plan with a higher deductible. Under the NFIP, deductibles are maxed out at $10,000. Choosing a high-deductible plan will significantly reduce your monthly costs, but you will have to pay more out-of-pocket should you experience extensive flood damage.

To get the best flood insurance, it pays to shop around and compare. Keep in mind that if you’re looking for an NFIP policy, rates will be more or less the same between providers. However, you may qualify for a discount if you bundle policies under one insurer which can reduce your overall premium costs.