USAA Home Insurance - 2025 Review

USAA was founded in 1922 as the United Services Automobile Association. As the name suggests, the company originally insured the vehicles of Army officers. Today, USAA offers multiple financial products for military members and those in the military community, including boat insurance, cell phone insurance, retirement funds, and bank accounts.

As one of the best homeowners insurance companies, competitors of USAA include:

- Farmers Insurance

- Liberty Mutual

- American Family

- Progressive

- Amica

- Lemonade

- Allstate

- State Farm

- Erie Insurance

USAA Home Insurance: Company Overview

USAA is a leading provider of homeowner’s insurance in the United States, covering all 50 states and Washington, D.C. Catering to the military community, USAA provides exclusive benefits to military homeowners, whether they’re living in the States or deployed overseas, such as standard replacement cost and specific items covered with no deductibles.

👍

Pros

- Available in all 50 states and Washington, D.C.

- No deductibles for military uniform coverage

- Replacement cost comes standard

- Numerous discounts available

👎

Cons

- Not available to people outside of the military community

USAA home insurance is available in all 50 states and Washington, D.C.

USAA home insurance is highly rated by customers, with homeowners praising its quick attention to claims, affordable rates, and the perks that come along with membership. Unlike many other homeowner’s insurance companies, USAA is available nationwide, protecting homes in every state and Washington, D.C.

Unfortunately, USAA homeowner’s insurance is not available for all homeowners across the country, as only military personnel, veterans, and family members are eligible for member benefits.

Who Can Join USAA?

USAA’s history is grounded in representing the military community, starting with the small group of Army officers who originally founded the company. Today, USAA home insurance is still only available within the community, covering current military members, veterans, pre-commissioned officers, and spouses and children of military members.

Joining members must prove their association with the military upon joining. Once a military member is approved for USAA membership, their family members can usually be added easily. USAA membership is free for those who sign up, although some products may have associated fees.

What Does USAA Home Insurance Cover?

USAA includes several types of insurance coverage within its standard home insurance policies.

USAA coverage includes:

- Dwelling coverage: Dwelling coverage from USAA protects the structure of a home and other attached structures, like a covered porch. Some companies require homeowners to add additional coverage for detached structures, like detached garages or fencing, but USAA includes many of these structures – even pools – under its standard dwelling coverage.

- Personal property coverage: Personal property insurance covers personal belongings, like furniture, electronics, and appliances, when a home is damaged due to a covered event.

- Personal liability coverage: Liability insurance protects homeowners who are responsible when an injury occurs on their property or when a homeowner causes an injury or property damage on someone else’s property.

- Loss of use coverage: Homeowners who cannot live in their home due to a covered event while it gets repaired or replaced can use this coverage to help afford housing and other costs related to living outside the home, like meals.

USAA home insurance protects against various covered perils, also known as hazards, including theft, vandalism, fire, wind, power surges, freezing, ice damage, and vehicle crashes.

One particularly nice feature is that replacement cost comes standard with USAA home insurance. Replacement cost coverage allows a home to be repaired or replaced at today’s value rather than at a cost calculated with depreciation.

Additional Insurance Coverage

In addition to standard insurance coverage, a homeowner can choose to customize their USAA home insurance with additional insurance coverage based on their needs. The following extra coverage options are available for most homeowners who are USAA members.

Valuable Personal Property Insurance

Valuable personal property insurance is USAA’s protection for high-value items you’d like to name specifically in your policy. Using this insurance lets you add extra coverage for items that may cost a lot to replace because of their higher-than-average value, like collections and jewelry. USAA also allows guns, silverware, artwork, furs, and musical instruments to be covered under this type of insurance.

However, certain damages or loss of value aren’t covered, such as typical depreciation, some water damage events, and rot caused by bacteria, mold, or mildew.

High Value Home Insurance

High value home insurance is specifically for homes and condos with high purchase prices or coverage needs of at least $1.5 million. Since high value homes cost more to replace and typically have more personal belongings to cover, they require higher coverage limits. High value home insurance policies from USAA will typically have higher premiums than standard home insurance to provide the comprehensive coverage these homes need.

Homeowners also get a few additional benefits with these plans, including coverage for ransom or extortion, large loss deductible waivers, and risk consulting.

Umbrella Insurance

Umbrella insurance provides additional liability insurance beyond what a standard home insurance policy and other insurance policies from USAA cover. Umbrella insurance is available from USAA for up to $5 million in coverage. Most states require homeowners adding umbrella insurance to their policies also to have car insurance through USAA.

Flood Insurance

Homeowners living in flood-prone areas might be required to carry flood insurance on their home insurance policies. Those not required to do so may still elect to include it to protect against damage caused by flooding.

USAA’s flood insurance comes from the National Flood Insurance Program. Coverage not only includes protection against traditional floods from rainwater but also from flooding caused by ice melting and hurricanes.

Windstorm and Hurricane Insurance

USAA’s windstorm and hurricane insurance is specifically for homeowners living in areas more prone to these types of storms, such as coastal locations. Specifically, the company extends this insurance product to homeowners in Florida, Alabama, Texas, Mississippi, North Carolina, and South Carolina. In addition to hurricanes and windstorms, this coverage protects against damage from tornadoes and hail.

Pricing and Costs

Home insurance is a necessity for homeowners. This vital coverage protects your personal property and home from a variety of potential hazards. The affordability of home insurance is something many homeowners worry about.

The average homeowner pays anywhere from $1,200 to $2,000 in home insurance per year, with the typical cost falling in the $1,700-$1,900 range. That equals about $141 to $158 per month.

Because USAA insurance is designed to provide the military community with affordable coverage, it generally falls lower than national averages. Homeowners can expect to pay between $900 and $2,000, on average, for USAA home insurance, depending on their location, the size of their home, and the types and amount of coverage they need.

Deductibles

Another way to lower premiums through USAA home insurance is to change your deductible amount.

A deductible is the amount of money a homeowner is responsible for paying before the insurance provider pays its portion of a claim. For example, a homeowner with a deductible of $1,500 for dwelling coverage has to pay $1,500 for repairs to a covered porch that was damaged during a windstorm before insurance pays for the remaining portion of the repairs.

Sample Payment

- Total cost of damages: $3,500

- Your deductible: $1,500

- USAA pays: $2,000

By increasing your deductible for USAA insurance, you may be able to lower your premium. This is because you become responsible for paying more of a claim, placing less of the responsibility on the insurance company. Therefore, your insurance moves some of its savings onto you by lowering your premium.

Be cautious about increasing your deductible, though. Never increase it to an amount more than you’d feel comfortable paying in the event that you need to use your insurance. For instance, having to pay a $2,000 deductible when worrying about damages could add more worry and anxiety to the situation.

Discounts

Want to save money on your USAA home insurance? Fortunately, the insurance company provides several discounts for USAA members to take advantage of to lower their premiums. The following discounts can be applied to eligible homeowners insurance policies through USAA.

Bundle Savings

Homeowners who add a USAA home insurance policy to their account while also enrolled in a USAA auto insurance plan can get a bundle discount of up to 10%. Homeowners can also be eligible for other discounts from their home insurance or auto insurance policies to save on either plan.

If you don’t currently have a USAA car insurance policy when you sign up for home insurance, you can switch your insurance to USAA during the process to take advantage of the discount.

Connected Home Discount

USAA’s Connected Home program rewards homeowners who take additional steps to ensure the safety and security of their homes. Once you have a homeowner’s policy in place, you can enroll in the program and buy eligible devices, like smoke detectors and security cameras, to connect to the program.

Throughout the program, USAA collects data from your devices to monitor your home’s safety and security. You can also use an app to check on any of your devices at any time.

Just by enrolling in the program and keeping these devices connected, you can get a discount on your USAA home insurance policy.

Protective Device Credit

You don’t necessarily have to enroll in Connected Home to get credit for your security and safety devices. If you already have some installed when you sign up for a home insurance policy, you may qualify for the protective device credit, which gives a discount of up to 5% off your premium.

Multi-Product Discount

While the bundle discount from USAA is strictly for people who have auto insurance and either home or renter’s insurance through USAA, the multi-product discount rewards USAA members who have other insurance products from the company, too. For example, a homeowner without auto insurance but with life insurance or valuable personal property coverage could get up to 5% off as a policy discount.

Loyalty Savings

Keep your USAA homeowner’s insurance policy in good standing with the company for at least three years to get the loyalty savings discount. This discount rewards loyal customers with up to 5% off their premium.

Claims-Free Discount

Although home insurance is there for you to use when you need it, insurance companies like to see everything go well with your home. When you go at least five years without claims against your USAA home insurance policy, USAA can reward you with a claims-free discount of up to 15%. For a $1,500 annual policy, that’s up to $225 in savings each year.

Perks and Shopping Discounts

In addition to regular policy discounts, USAA members can get several extra perks that add to the overall affordability of having a membership.

For starters, USAA members get multiple shopping discounts for products and services they might already use or want to try. Travel packages, hotel stays, home security products and services, and moving and storage services are just a few items USAA members can receive discounts on. For example, members can save up to 35% on car rentals and up to 60% on cruises.

USAA members also get entertainment discounts for services like TV streaming, theme parks, and cell phone service. Health-focused discounts are also available through fitness platforms, meal subscription services, and prescription services.

Visit USAA’s member perks page to learn about other potential savings when you become a USAA member.

How to Get a Quote

Only USAA members or people who are able to sign up for USAA membership can get an online quote for homeowner’s insurance by logging into their online accounts or joining USAA online. Otherwise, homeowners interested in a quote should call USAA customer service to speak with a representative to learn about USAA membership, insurance policies, and quotes.

How to File a Claim

USAA’s online account system is where members and policyholders can go to file a new claim in just a few minutes. The online system allows homeowners to describe the claim and upload documentation or photos to help USAA process the claim as quickly as possible. USAA will reach out if any additional information is necessary to complete the claim. Homeowners can then view the status of the claim via their online accounts, too.

Alternatively, USAA customer service is available by phone for claims submissions, which may be helpful for homeowners who prefer discussing their claims verbally.

Customer Service Contact Info

Current USAA customers can log into their online accounts to send secure messages to USAA about their home insurance policy.

Alternatively, customers and non-customers can use the website’s automated live chat feature to ask questions or get more information about USAA home insurance. To speak with a customer service representative, call (210) 531-8722 from 7 a.m. to 6:30 p.m. in any time zone, Monday through Friday.

For specific situations and insurance products, visit USAA’s customer service page to find the best number to contact.

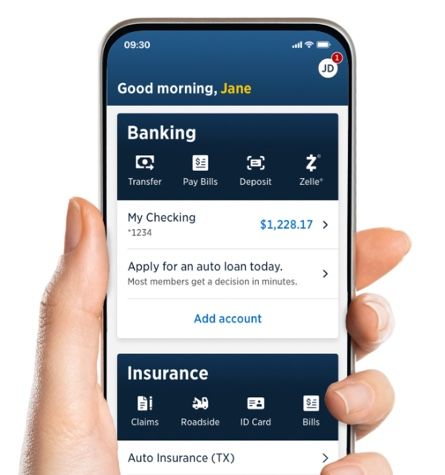

USAA Mobile App

Homeowners can quickly and conveniently sign into the USAA mobile app to get information about their policy or check on a submitted claim when on the go with the USAA mobile app.

The app features layered security to keep your information safe, Smart Search to help you find the information you need, and automated chat to get simple questions answered quickly. You can also pay your insurance premiums and report claims directly through the app.

The USAA mobile app is available in the App Store and Google Play.

Is USAA Homeowners Insurance Right for Me?

USAA home insurance is among the best homeowners insurance options for the military community. Military members, veterans, and their families are eligible to become USAA members, allowing them access to shopping discounts and numerous other benefits that aren’t usually available with most insurance companies. Plus, USAA membership is completely free, so all the benefits come at no extra cost.

Additionally, USAA is available in all 50 states, leaving no homeowners behind just because of where they live. USAA’s rates are generally affordable across the country, and homeowners have several ways to reduce their premiums, like adjusting their deductibles or qualifying for the multiple discounts USAA offers. Military members can also get deductible-free coverage for their military uniforms in the event that they become lost or damaged from a covered event.

On the other hand, people who are not connected to the U.S. military cannot sign up for USAA membership or take advantage of USAA homeowners insurance.

USAA lets its members get quick quotes online to help them determine whether its home insurance is the right choice. If you’re not a member but are eligible to become one, you can sign up easily online to continue the quote process. We recommend pulling quotes from a few companies that serve your area in addition to USAA to compare coverages, premiums, and eligible discounts as you search for the best company suited to your needs.