Pet Assure - A Unique Alternative to Traditional Pet Insurance

Pet Assure provides its members with significant discounts on veterinary services, though it doesn’t work like traditional pet insurance. Read our Pet Assure review below, and we’ll outline all you need to know about the company’s products and services including what is and isn’t covered, how to sign up for a plan, and pricing information.

Company Overview

Pet Assure was founded in 1995 and is headquartered in Lakewood, New Jersey. The company was started by Jay and Caroline Bloom in response to their own difficult experience when their golden retriever, Lucky, had to undergo hip surgery and their pet insurer wouldn’t cover the $3,000 procedure. They decided then to create a new kind of pet healthcare service that gave pet owners more flexibility and options when it came to affording costly veterinary treatment.

👍

Pros

- Unlimited reimbursements

- Diminishing deductible reduces by $50 every year you don’t have a claim

- Dental illness coverage included

👎

Cons

- Does not cover prescription food, vitamins, or supplements

- Dogs over the age of 15 only qualify for accident-only coverage

- Coverage costs more than some of the competition

Option to Pay Vet Directly: No

App Support: Yes

Accident Waiting Period: 2 Days

Illness Waiting Period: 14 Days

Orthopedic Waiting Period: 6 Months (14 days if you go through orthopedic exam and waiver process)

Vet Helpline Available: Yes

Multi-Pet Discount: Yes

Deductible Type: Annual

Pet Assure works with licensed vets in all 50 states, plus Puerto Rico and Canada. The company also holds an A+ rating from the BBB and is part of the Synergy Pet Group Company, which also partners with brands like Pet Benefit Solutions, Shepherd, Wishbone Pet Health Insurance, and ThePetTag.

As one of the best pet insurance companies, competitors of Pet Assure include:

- ASPCA Pet Health Insurance

- Embrace Pet Insurance

- Healthy Paws

- Lemonade Pet Insurance

- ManyPets

- Nationwide Pet Insurance

- Pets Best Insurance

- Prudent Pet

- Pumpkin Pet Insurance

- Spot

- Trupanion

Why We Chose Pet Assure

Pet Assure offers a unique product for pet owners looking to save money on veterinary services. As an alternative to pet insurance, Pet Assure offers its members a flat 25% discount on vet care with two coverage options: one for employees who have access to Pet Assure through an employer benefits package, and another wellness plan for customers who want to purchase directly from the company.

Monthly costs are low compared with many other pet insurers, particularly if you work at a company that partners with Pet Assure. These savings are helpful to pet owners who are also trying to juggle other financial responsibilities like paying their mortgage, homeowners insurance, car insurance, and other personal expenses.

The discount program is great for those who have a pet with a pre-existing condition, a hereditary condition, or is at an age that could disqualify them from getting traditional pet health coverage. The plan is easy to understand, can be used immediately after signing up (meaning there’s no mandatory waiting period), and can be used for exotic pets in addition to cats and dogs. Lastly, you’ll never have to file any claims, and there’s no limit on how often you can use the discount.

How Pet Insurance Works with Pet Assure

Although Pet Assure competes with the best pet insurance companies like Pets Best, Lemonade, and Embrace Pet Insurance, it’s important to point out that Pet Assure is not an insurance provider. Instead, it’s a discount plan that pet owners can use to purchase veterinary care through a participating provider. Unlike other traditional pet insurance plans where you have to worry about meeting your deductible or filing a claim on time, you’ll simply show your Pet Assure card when receiving medical service from a participating vet and you’ll receive 25% off on your final bill.

What’s Covered

As long as you see a participating veterinary and receive in-house services, your discount plan should cover most services and treatments such as:

- Pre-existing conditions like cruciate ligament conditions or hip dysplasia

- Spaying and neutering

- Dental cleanings

- Hospitalization

- Surgical procedures

- Sick visits

- Parasite screenings

- Ultrasounds

- Allergy tests

- Vaccinations

- Elective procedures

- Specialist care

- Chronic conditions

- Wellness visits

- Diabetes management

- Routine care

- Tumor removal

What’s Not Covered

Because Pet Assure doesn’t offer standard insurance plans to its members, there aren’t the typical exclusions that you may find under a more traditional policy. That said, services from out-of-network providers will not be eligible for the 25% discount, and the Pet Assure discount can’t be used in combination with other offers or discounts your provider may be offering. Additionally, non-medical services will not be covered such as:

- Grooming

- Boarding

- Microchipping

- Outsourced services

- Prescription food

- Prescription medication

- Flea or heartworm preventatives

- Mileage fees

- Virtual vet visits

Plans

Pet Assure’s main plan is called America’s Veterinary Discount Plan which is only available as an employee benefit. Other pet owners who want this type of discount plan can sign up for the Mint Wellness program which we’ll describe below.

The Pet Assure Discount plan can only be used with participating vets, but the good news is there are thousands across the country. To see if your vet is partnered with Pet Assure, you can search for them here using their address or zip code. If your preferred practice has not yet joined the Pet Assure team, you can request that they do so by clicking the “Invite This Vet to Join Pet Assure” button or by filling out this form to invite them. You can sign up for the employer-sponsored plan for either a single cat or single dog plan, a family plan that includes two to four animals of any size, or an unlimited plan for those with over four pets in their household.

Wellness

For those who can’t get Pet Assure coverage through their employer, the company offers access through a routine care plan that’s available to anyone through its Mint Wellness program. Mint Wellness works on a reimbursement basis much like a health savings account for human health insurance, so it’s different from both a traditional pet insurance plan and the discount program. This allows pet owners to bring in any kind of pet (dogs, cats, and exotic pets are covered) for routine veterinary services to any licensed veterinarian they like and get reimbursed up to a pre-set limit for certain services.

As a pet parent, the Mint Wellness plan lets you choose from three levels of care, all of which are effective immediately after signing up:

- Basic: Basic coverage reimburses you a maximum of $350 a year and can be used for one wellness visit, two vaccinations, bloodwork, and one fecal test or urinalysis.

- Essential: Essential coverage reimburses a maximum of $650 a year for the above services plus an additional vaccination, grooming, and preventatives.

- Premium: At the premium level, you’ll get a maximum reimbursement of $1,100 a year for the veterinary treatment listed in both the Basic and Essential plans, plus an additional wellness visit, four total vaccinations, and dental coverage.

All Mint Wellness plans also come with ThePetTag service. This is a unique and durable pet ID tag that helps owners find their pets faster by using the company’s Lost Pet Recovery Service. Additionally, you’ll also gain access to the Veterinary Discount Plan where you’ll be issued a Pet Assure discount card you can present to a participating veterinarian and receive a 25% discount on in-house medical services.

How Much Does Pet Assure Cost?

The Pet Assure website only lists pricing for its Mint Wellness plan. It does not include online quotes for its America’s Veterinary Discount Plan since this is administered as an employee benefit. For pricing on the employer plan, you should contact your HR department or contact Pet Assure directly.

Mint Wellness Plan pricing:

| Monthly premium | Maximum annual payout | Potential annual savings | |

| Basic | $18 | $350 | $134 |

| Essential | $34 | $650 | $242 |

| Premium | $57 | $1,100 | $416 |

Most members also have the option to receive a discount for paying their annual membership in one lump sum instead of in monthly installments.

How To Sign Up

The Pet Assure Veterinary Discount Plan is only available as an employee benefit, and you can see if your employer has partnered with Pet Assure using the lookup tool. If you’re unsure, you can also ask your HR department directly if this is a benefit they offer. Currently, there are over 6,000 employers in the country who participate, but if yours is not yet included, you can invite them by filling out this form on the Pet Assure website.

If you’d like to sign up for the Mint Wellness Plan, click on the “Get a Free Quote” button on the company’s website, then fill out basic information about you and your pet to get started.

How To File a Claim

The employer-based Pet Assure discount plan is easy to use because you never have to file a claim. All you need to do to get your benefits is provide your Pet Assure membership details at the time of payment and you’ll receive your discount.

For Mint Wellness customers, you will have to file a claim for reimbursement, but this is a simple process as well. You’ll do this by logging into your online account and submitting an itemized invoice from your vet along with your proof of payment within 90 days of the date of treatment. Once your claim has been processed, reimbursements are made directly to you either through a Venmo or PayPal account, whichever you’ve set up in your Mint Wellness account. Most claims are processed and paid within five business days,

Contact Information

Contact the Pet Assure customer service team by email at customercare@petassure.com, or by phone at (888) 789-7387, Monday through Friday from 8:00 am to 6:00 pm EST.

If you’re an existing Pet Assure customer and have a plan through your employer, you can log in to your employee benefits account to see details about your coverage as well as payment details.

If you are a Mint Wellness customer, log in to your account on PetAssure.com.

How To Cancel

Veterinary Discount Plan members can request a refund within 45 days of their enrollment date.

Mint Wellness plans may be eligible for a refund through the company’s 30-day money-back guarantee. Mid-term cancellations can also be requested by Mint Wellness customers, but you may be responsible for paying an early termination fee and a $10 monthly service fee for each month the plan was active. However, Pet Assure does exercise some discretion with these additional fees in the case of a deceased pet.

Mobile App

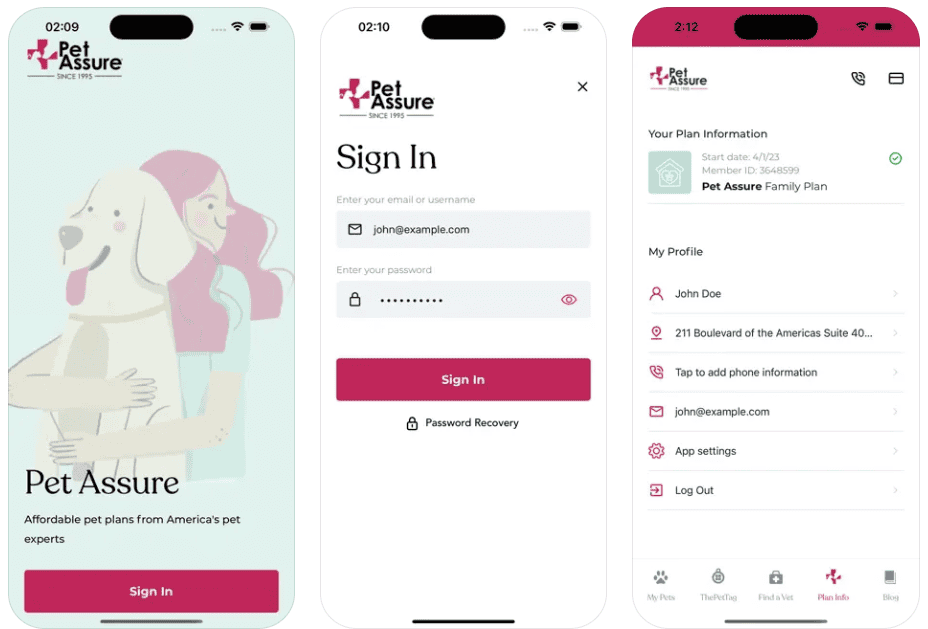

Using the Pet Assure app is one of the easiest ways to make payments, connect with the customer service team, find details about your coverage, add or remove pets, and access your digital ID card. You can download the app from Google Play and the Apple App Store.

Is Pet Assure Right for Me?

Most pet owners have a lot of options when searching for a pet insurance company, but many may find themselves ineligible for coverage. This could happen if you have an elderly pet, a pet with pre-existing conditions, or an exotic pet, for example.

For these pet owners, a Pet Assure Plan may be the only real option they have to save money on vet bills. And, even though it’s only 25%, this can add up to real savings if you know your pet will need continuing and extensive care. That said, even for pet owners who do have a current pet insurance plan, Pet Assure may be beneficial as a supplemental policy to fill in the gaps in care that a traditional pet insurance policy leaves open.