Embrace Pet Insurance - Coverage & Pricing in 2025

As any pet parent can tell you, vet bills – both planned and unexpected – can add up to hundreds or thousands of dollars a year and prices for these services are on the rise. If you’re a pet owner who struggles to keep up with the costs of veterinary care, you may consider taking out a pet insurance policy. These work in much the same way as car or homeowners insurance, reimbursing you for costs associated with unexpected accidents or illnesses.

If you have multiple pets, a pet with a chronic condition, an elderly pet, or you just like saving money, you may benefit from this type of insurance. Over the past decade, options for pet insurance have expanded greatly, giving consumers more custom choices. One of the most popular providers is Embrace Pet Insurance.

Company Overview

Embrace Pet Insurance has been in business since 2003, has an A+ rating with the BBB, and is frequently ranked as one of the best pet insurance companies on the market. Its plans are underwritten by American Modern Insurance Group, Inc., rated A+ (Superior) by A.M. Best. The company offers comprehensive insurance plans in all 50 states and the District of Columbia.

👍

Pros

- Unlimited reimbursements

- Diminishing deductible reduces by $50 every year you don’t have a claim

- Dental illness coverage included

👎

Cons

- Does not cover prescription food, vitamins, or supplements

- Dogs over the age of 15 only qualify for accident-only coverage

- Coverage costs more than some of the competition

Option to Pay Vet Directly: No

App Support: Yes

Accident Waiting Period: 2 Days

Illness Waiting Period: 14 Days

Orthopedic Waiting Period: 6 Months (14 days if you go through orthopedic exam and waiver process)

Vet Helpline Available: Yes

Multi-Pet Discount: Yes

Deductible Type: Annual

Embrace is frequently included on “best of” lists for being a great place to work and is committed to its philanthropic mission to give back to the community, having donated over half a million dollars to charity as well as matching 100% of employee contributions to charities. Embrace sponsors events both locally in the Cleveland area and at a national level.

As one of the best pet insurance companies, competitors of Embrace include:

- ASPCA Pet Health Insurance

- Healthy Paws

- Lemonade Pet Insurance

- ManyPets

- Nationwide Pet Insurance

- Pet Assure

- Pets Best Insurance

- Prudent Pet

- Pumpkin Pet Insurance

- Spot

- Trupanion

Why We Like Embrace Pet Insurance

Embrace has made a name for itself over the past 20 years as a top-level pet insurance provider, offering customers a range of coverage options they can customize to fit their needs. It’s also frequently rated as one of the best pet insurance agencies in the country when compared side by side with reputable companies like ASPCA Pet Health Insurance or Healthy Paws Pet Insurance.

Customers of Embrace like the flexibility to choose coverage options that meet both the needs of their pet and their pocketbooks. It’s also one of the few companies to insure dogs and cats with some curable pre-existing conditions and include services for dental illness as part of its basic plan. Furthermore, because it works on a reimbursement model, there are no in-network or out-of-network providers, so you’re free to use any vet you like.

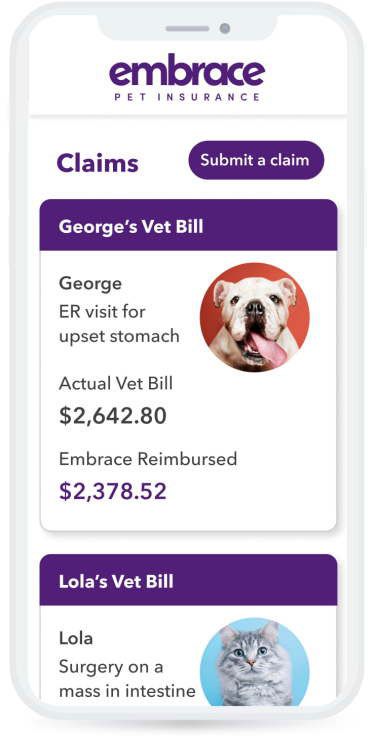

The company’s streamlined claims process allows policyholders to use either their online account or mobile app to submit a claim, eliminating the need to fill out multiple forms. It’s worth noting that the overall costs for Embrace’s plans tend to be higher than their competitors. However, the company ranks high for customer satisfaction, earning an average of 4.2 out of five stars based on over 2,000 consumer reviews collected by Pawlicy Advisor.

What Is Pet Insurance?

A standard pet insurance plan covers unexpected veterinary expenses, namely due to injury and illness. However, unlike a typical health insurance plan, most of these policies won’t cover routine care or preventative care. Additionally, most pet insurance coverage works on a reimbursement model, meaning you still have to pay upfront for vet bills, and then submit a claim to be reimbursed according to the details of your policy.

What Is Typically Covered

Most pet policies only cover cats and dogs, and do not offer options for “exotic animals” like birds, reptiles, rabbits, amphibians, or mice (in fact, Nationwide is the only insurer to provide this). Though your coverage will depend on the plan you choose, a basic policy will likely cover:

- Exam fees

- Emergency care

- Chronic conditions

- Specialist visits

- Conditions that are specific to a certain breed

- Prescription medication

- Surgery, both scheduled and unscheduled

- Diagnostic testing

What Is Typically NOT Covered

- Pre-existing conditions

- Cosmetic procedures

- Prescription diet food

- Services related to breeding

- Dental services

Modern consumers are used to the different types of insurance they need to carry in their everyday lives. While some of these are mandated, others are optional. Today, more and more pet owners are purchasing a pet insurance plan that covers veterinary care.

Embrace Pet Insurance - Plans and Coverage

Embrace’s basic insurance plans for dogs and cats cover accidents and illnesses, as well as vet services that many companies don’t include, like dental and some curable pre-existing conditions. Extended care coverage for routine and preventative services is only offered as part of the Wellness Rewards program (more on that below).

Note that for any new policy, your pet must be seen by a veterinarian within the 12 months before you purchase a plan and this documentation must be provided upfront. This allows Embrace Insurance time to review your pet’s medical history and determine if they have any pre-existing conditions that could affect your coverage.

Dog Insurance

Typically, dogs cost more to insure than cats, and you can expect premium payments to be roughly twice as expensive for dogs than cats. Dogs are eligible for this plan from age six weeks until they turn 15. After this, they are only eligible for an accident-only plan, which offers a 90% reimbursement up to $5,000 a year after meeting a $100 deductible.

What’s covered

- Exam fees

- Prescription medication

- Surgeries

- Prosthetic limbs and mobility devices

- Rehabilitation and follow-up care

- Emergency care

- Diagnostic testing

- Behavioral therapy (this is different from training classes which are not covered)

- Dental illnesses (up to $1,000) and accidents

- Treatments and procedures

What’s NOT covered

- DNA testing

- Cosmetic procedures like grooming and nail trimming

- Pre-existing conditions (there are exceptions to this that are noted below)

- Breeding

- Training classes

- Nutritional supplements

- Spaying and neutering

Cat Insurance

Cats can be covered from as young as six weeks up to their 15th birthday. Once they turn 15, they can only be covered with accident-only insurance.

What’s covered:

- Dental illnesses (up to $1,000) and accidents

- Diagnostic testing

- Exam and consultation fees

- Specialists and ER care

- Complementary treatment (previously known as alternative therapy)

- Rehabilitation

- Hospitalization & surgery

- Hereditary conditions

What’s NOT covered

- Routine care

- Procedures categorized as “medically unnecessary or cruel” such as declawing or devocalization

- Spaying and neutering

- Prescription food

- Teeth cleaning

Pet Wellness Rewards Plans

Wellness Rewards is a coverage option that can be purchased in addition to your regular pet insurance policy. While a standard injury and illness plan covers unexpected costs and services, the Wellness Rewards plan is for preventive and routine veterinary services including wellness exams, training, grooming, nutritional supplements, spaying and neutering, and teeth cleaning.

Choose Your Level of Reimbursement:

- $250 allowance per policy year

- $450 allowance per policy year

- $650 allowance per policy year

Importantly, this wellness coverage is not an insurance policy and works more like a Flexible Spending Account (FSA). You’ll first choose from one of three levels – $250, $450, or $650 – depending on the anticipated needs of your pet. Then, you pay into this account either monthly or annually and by doing so, receive a $25 annual reward from Embrace. Once you set up the account, you can submit claims for reimbursements throughout the year like an FSA.

Regardless of whether you pay monthly or annually, your full Rewards benefit will be available from the first day your policy begins.

Pet Dental Insurance

Embrace is one of the few pet health insurers to include dental coverage as part of its standard policy. This coverage includes services for dental accidents or illnesses that are not pre-existing, but it does not cover routine dental care like cleanings (for help with these expenses, look into the company’s Wellness Rewards program).

Common dental services include:

- Gingivitis

- Extractions

- Root canals

- Periodontal disease

- Chipped or broken teeth

Embrace’s dental coverage for accidents is subject to your plan’s coverage limit while dental illnesses are only covered up to $1,000 per policy year.

Pet Insurance & Pre-existing Conditions

There is currently no pet insurance company that covers pre-existing conditions. However, even if there is a pre-existing condition, this does not mean you’ll be unable to insure your pet; you just won’t be able to submit a claim for that particular condition.

Embrace differentiates between pre-existing conditions that are considered curable and those that are not. This determination will inform your coverage options. In general, a curable pre-existing condition may be covered in cases where your pet is symptom- and treatment-free for 12 months. For example, if your cat had a bladder infection over a year ago and has since shown no related symptoms and has required no additional medical care for the condition, it will likely be covered by your policy going forward. Incurable conditions are never covered.

Full Coverage Pet Insurance

Embrace Pet Insurance prides itself on providing some of the most comprehensive policies for pet owners covering vet services for cancer, dental illness, injuries, congenital and genetic conditions, orthopedic conditions, chronic conditions, preventable conditions, and some curable pre-existing conditions.

How much does Embrace Pet Insurance Cost?

Many factors can affect the cost of pest insurance. The only way to get an accurate idea of your pet insurance costs is to contact the company and request a quote for your specific pet. However, it’s worth considering the various factors that will affect your estimate ahead of time.

Factors that can affect the cost of your plan:

- The species, breed, and size of your pet

- The age of your pet

- Your location

- Whether your pet has a pre-existing condition

- Your chosen level of coverage, deductible, and reimbursement percentage

On average, you’ll pay more for dog health insurance than cat insurance, with average monthly costs at $18-$72 for dogs, and $8-$38 for cats. Having said that, your pet’s needs and the level of coverage you want will be the biggest deciding factors in your overall costs.

Consider the following when estimating cost:

- Deductible: All plans come with a deductible, and this must be met before your policy will begin paying out. Typically a lower deductible means you’ll pay a higher monthly premium, and a higher deductible results in a lower monthly premium. Deductibles typically range from $200 to $1,000.

- Annual limit: After you meet your deductible, your plan will begin paying out on all covered services up to your annual limit. Once you reach your reimbursement limit, you’ll be responsible for paying 100% of any additional expenses. Most Embrace plans have an annual limit, though you may be able to choose a plan with an unlimited maximum payout. Most annual limits start at $5,000.

- Reimbursement percentage: Your reimbursement percentage is the portion of your total claim you’ll receive back from Embrace, either 70%, 80%, or 90%. This means once you meet your deductible, your plan will pay out that percentage for covered services until you reach your annual limit. For example, if you’ve already met your deductible and submit a claim for $1,000 at 70%, you’ll be reimbursed $700. A higher reimbursement percentage results in a higher premium.

The Healthy Pet Discount Program

The Healthy Pet Discount Program allows regular customers to earn discounts for each year they remain claim-free. You can earn a 5% discount for the first year your reimbursements total less than $300 per pet, and a 10% discount for the second year. The discount is automatically applied if you qualify.

Other Ways To Save

You can save money through discounts for insuring multiple pets, military service, or by paying your premium annually.

- Multi-pet discount: Pet parents who insure two or more pets can receive a 10% discount on their policy.

- Military service: Veterans and those currently serving in the armed forces can receive a 5% discount on their premium.

- Pay in full: If you pay your premium in one annual payment instead of monthly, you’ll save $12 in processing fees.

These savings options help by reducing your costs. Insuring multiple pets or having military status gets you discounts. Paying yearly instead of monthly cuts down on extra fees.

How To Get Started

If you’d like to get a quote on a plan, you’ll start by submitting basic information about your pet through the company’s website. This includes the species, sex, breed, and age of your pet as well as your location and contact information. An Embrace rep will then contact you to give you detailed quote options. You can also call Embrace at (800) 779-1539 to get an estimate over the phone.

There is a mandatory waiting period for all plans which is typically two to 14 days depending on your plan and the type of care you’re seeking. However, there are some instances where the waiting period may be much longer. For example, orthopedic conditions for dogs may be subject to a six-month waiting period, though waivers are available.

Once you decide to purchase a plan, you’ll be required to pay a one-time activation fee of $25 along with your premium payment. This can be done with a credit card or through your checking or savings account.

How To Submit a Claim

Embrace tries to make the claims process as straightforward as possible. In most cases, this is best done by submitting a claim through the company’s website or the Embrace Pet Insurance app. However, those without this option can still submit a claim via email, fax, or physical mail.

Steps To Submit a Claim

1. Documentation

Gather all the details of your charges before you leave the vet. This includes an itemized invoice with totals, taxes, and any discounts as well as a description of your pet’s diagnosis. If possible, get both a physical copy and a digital copy. If you are not using the Embrace website or app to submit, you may need to have your vet fill out a claims form for you.

2. Submit Claim

The easiest way to do this is by logging on to your Embrace account either on the website or through the app. Select “Submit a Claim” and you’ll be prompted with step-by-step instructions. When prompted, you need to select the reason for the visit or diagnosis.

Once you upload the necessary documents and hit “submit,” you’ll receive an email confirmation within two days that your claim was received. You will also see that your claim status has been updated in your account and you can track its progress here.

3. Review Period

The claims review period can take anywhere from 10 to 15 business days. If there is missing information, Embrace will contact your vet and make any necessary updates to your account. If this is your first claim, the review process may take longer since your pet’s medical history for the previous 12 months must also be reviewed. Subsequent claims will not need this additional step. Wellness Rewards claims take an average of five business days to process.

5. Reimbursement

Embrace reimburses policyholders by check or direct deposit and this can be set up in your account. Checks sent by mail will take around 10 business days to reach you after the claim has been approved, while direct deposit arrives within about three business days.

How To Cancel

Cancellation requests must be initiated by phone at (800) 511-9172, or by email.

A few things to note:

- If you cancel your policy and then open another (either with Embrace or another pet insurer) and there’s been a lapse in coverage, any illness or injury can be considered a pre-existing condition and may not be covered.

- Cancellations made within 30 days of the policy start date are eligible for a full refund.

- Cancellations made after 30 days may be eligible for a prorated refund.

Customer Service Contact Info

Using the MyEmbrace portal or app is the easiest way to contact the company for your customer service needs. To receive a policy quote or purchase a pet insurance plan, call (855) 540-0591. To reach customer care, call (855) 540-2104.

Additionally, all plans have access to PawSupport, a 24/7 pet health line where you can receive support and guidance for pet health-related concerns. This support tool can only be accessed via your MyEmbrace online account (not the mobile app) where you’ll be able to get help via live chat, video conference, or phone.

Embrace Mobile App

The highly rated Embrace Pet Insurance app can be downloaded for both iOS and Android. This app gives you 24/7 access to your account so you can submit a claim, check on claim status, contact customer service, review your Explanation of Benefits (EOB), or review or change your coverage.

Is Embrace Pet Insurance Right for Me?

No matter what kind of coverage you’re looking for, whether it’s car insurance, health insurance, or homeowners insurance, you want to make sure you pick the right policy with the right insurance company. Embrace is routinely listed as one of the best pet insurance companies in the country, earning high marks for its comprehensive coverage that includes dental services, relatively short waiting periods, coverage for curable pre-existing conditions, its “diminishing deductible,” and access to its 24/7 support line, PawSupport. That said, Embrace does have slightly higher overall costs than other pet insurers, which is something to consider. If you don’t need extensive coverage, you may want to seek out a less expensive plan.

Embrace also offers customers flexibility when choosing the amount of coverage they need with multiple options for deductibles and annual limits. These coverage options make Embrace the ideal choice for someone looking for full insurance protection for their pet while remaining in control of their out-of-pocket expenses.