Rocket Money - 2025 Review

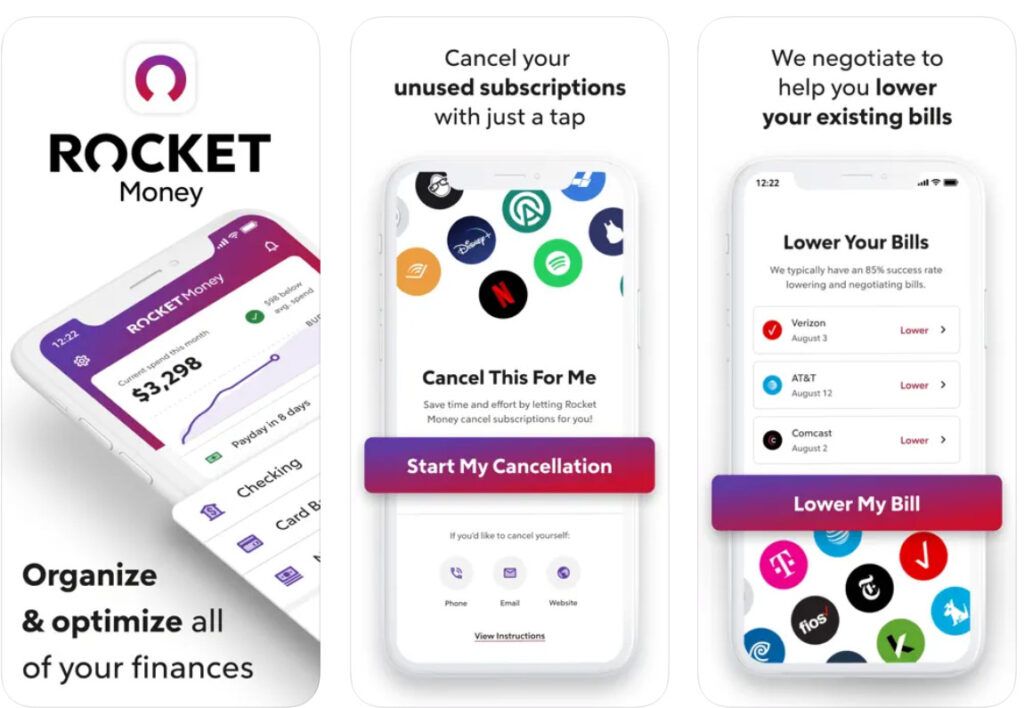

Rocket Money is one of the most well-known budgeting apps in the U.S. If you’ve listened to popular podcasts or the radio within the past couple of years, there’s a good chance you’ve heard an advertisement about it. This app promises to help you find and cancel unnecessary subscriptions while helping you save more and spend less. Learn whether it’s worth the hype.

Rocket Money Overview

Rocket Money is a budgeting and savings app that was originally known as Truebill, a personal finance app that was acquired by Rocket Companies in 2021. Rocket Companies also popular financial services, like Rocket Mortgage and Rocket Loans.

👍

Pros

- Automatic savings plans

- Pay-what-you-want model

- Can automatically cancel subscriptions and negotiate bills

- 7-day free trial

👎

Cons

- Bill negotiation costs at least 30% of your money saved

- Limited free features

- Live chat with customer service is only guaranteed for Premium members

Highlights

Type of Personal Budget: Traditional budget

Best For: Managing subscriptions

Cost: $4-$12/month

Free Trial: Yes

Links to Accounts: Yes; Bank, investment, and credit card accounts

Apple App Store Rating: 4.2/5

Google Play Rating: 4.3/5

Since its founding, Rocket Money has grown to over 5 million members and has helped customers save more than $500 million by canceling unwanted subscriptions. The app offers multiple features for people who want to take better control of their money, including automatic savings transfers, credit score monitoring, spending insights, bill negotiations, subscription alerts, and budgeting tools.

Why We Like Rocket Money

Rocket Money is quite a bit different from other budgeting apps. Yes, it provides the basic budgeting features you’d expect, like tracking your spending between different categories, keeping you updated with your savings goals, and automatically moving money into savings for you. But it also keeps track of your subscriptions in ways other budgeting apps don’t.

For example, Rocket Money notices that if you accidentally pay for two subscriptions for the same service, it will alert you to the error and cancel that subscription for you. Also, if you notice the price for a subscription keeps creeping up, and you want to try lowering it, you can ask Rocket Money to do that, potentially saving you money each month or year.

We also like that Rocket Money keeps you in the loop with your credit score, always making your score available to check on in addition to your credit report and history. This way, if you notice anything that needs to be corrected, you can fix the problem quickly.

Who Is Rocket Money Best For?

Rocket Money is best for people who sign up for a lot of subscriptions, like streaming platforms, music or audiobook services, or app subscriptions. Rocket Money can keep all of your subscription information together in one place when you connect your financial accounts to the apps, making it easier for you to track the prices of each subscription and see what you’re actually paying every month in subscriptions alone.

It’s also a helpful app for people who want some help negotiating their bills, as Rocket Money works with several popular companies to lower things like phone or internet bills.

Get started with Rocket Money!

Pricing & Plans

Rocket Money is unique in that it doesn’t have a set price for its membership, although its premium features are paid. You can start an account for free, but you won’t get access to premium features, like bill negotiation and subscription cancellations, unless you upgrade to a premium account.

| Plan Type | Price Range | Features Included |

|---|---|---|

| Free | $0 | Basic features only |

| Premium (monthly) | $6 - $12/month | Full access, including bill negotiation |

| Premium (annually) | $48 - $60/year | Full access, including bill negotiation |

Rocket Money offers a free trial for seven days but then charges a subscription. However, you get to choose how much you want to pay: $4 or $5 per month when billed annually for a total of $48 to $60 per year, or $6 to $12 per month if you’d rather pay monthly.

Keep in mind that Rocket Money charges a fee if it’s successful in lowering your bills, although the fee is still based on what you’d like to pay. Choose between 30% to 60% of the amount you save from the negotiation, so the ball’s still in your court to pay what you’re comfortable with.

Is Rocket Money Legit?

Many people wonder if Rocket Money is legit or is it a scam. Rest assured, Rocket Money is a legit budgeting app and not a scam. Over 5 million people have signed up for Rocket Money since it was acquired by Rocket Companies in 2016.

Here is how Rocket Money is rated by its customers:

| Platform | Customer Rating |

|---|---|

| Apple App Store | 4.2 |

| Google Play | 4.3 |

| Trust Pilot | 4.5 |

| Trustindex | 4.2 |

| Better Business Bureau (BBB) | B (Accredited) |

What People Are Saying About Rocket Money

While most comments about Rocket Money are positive, there are some negative reviews as well. Let’s take a look at what customers are saying about Rocket Money.

Here are some customer comments from TrustPilot:

While many customers are pleased with Rocket Money, Lisa from TrustPilot provided some honest criticism:

How Rocket Money Works

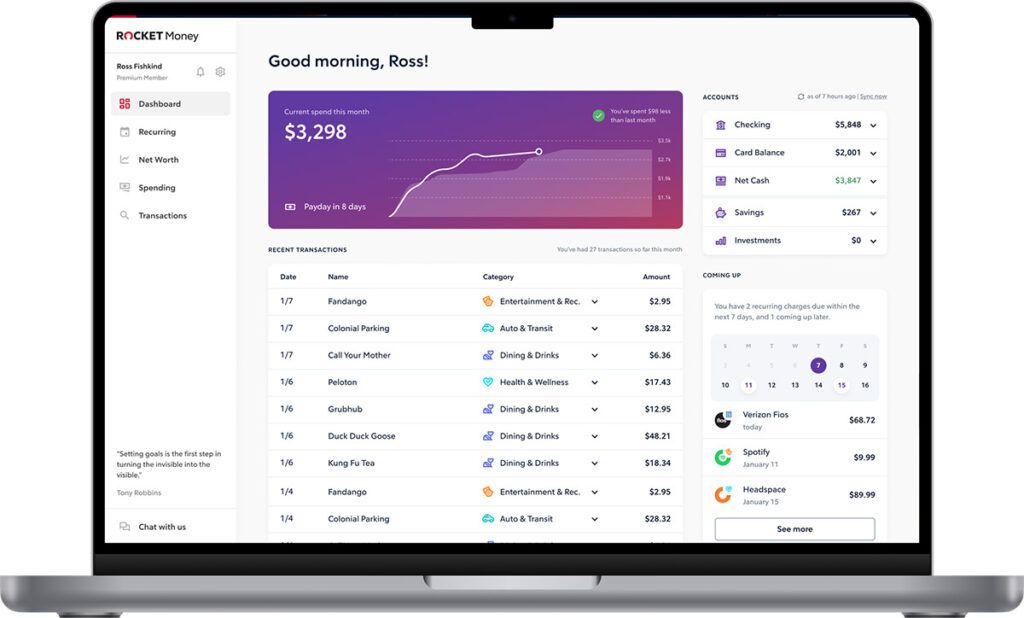

Rocket Money uses a traditional budgeting system that tracks your income and lets you know how much money you have left after your expenses are removed from your income. This gives you some wiggle room to budget how you see fit using whatever types of personal budgets you want while still staying on top of your spending.

It’s important to note that Rocket Money is more for subscription and bill management than budgeting, per se. The app does have a feature called Spending Insights, which breaks down your expenses into different categories, like bills, loans, groceries, etc., so you can see how much you spend on different types of transactions. Rocket Money connects to your financial accounts, imports your transactions, and categorizes them to assist this feature.

Rocket Money lets you create spending allowances by category.

You can create spending allowances for each category to make sure you don’t overspend and set savings goals to monitor your progress. You can also set a specific amount of money for Rocket Money to move toward each of your savings goals on a frequency you choose. Your automatic savings plan recurs, so you won’t have to worry about remembering to move the money you want to your savings.

However, Rocket Money’s subscription management is its main offering and where a lot of users find the most value. The app will automatically detect duplicate transactions – say, if you accidentally signed up for the same app subscription twice – notify you, and cancel one of those subscriptions to save you money. You can also have Rocket Money cancel any subscriptions you no longer need and keep tabs on all the money you spend on subscriptions each month or year.

Rocket Money also helps you lower how much you spend on certain bills, namely phone, cable, and internet bills. This happens through its bill negotiation service. Let Rocket Money know what bill you’d like to lower, and they’ll negotiate the bill with the company. For example, if you have a Spectrum bill that recently went up from $60 to $80, Rocket Money can potentially help you lower it back to $60 or even lower.

For this service to work, you’ll need to pay a percentage of however much you save, between 30-60%. So, say Rocket Money saves you $24 per month, or $288 per year, on your Spectrum bill. If you choose to pay Rocket Money 50% of your savings, you’ll pay $144 and still save $144 on your bill for the year.

The app can also attempt to get you refunds on overdraft fees charged by your bank and find you better deals on auto insurance based on what you currently pay.

You can stay updated with your credit score and net worth with Rocket Money by navigating to those features on the app. The credit score area shows you important information about your score and credit history, while the net worth section displays your investments and monitors your overall financial health.

How To Sign Up for Rocket Money

Sign up for Rocket Money on the website by filling out the form with your name and email address. You can then view your account online or download the Rocket Money app on the App Store or Google Play to use it on your mobile device. You can also use the app to sign up for an account if you don’t already have one by filling out a quick form and setting your password.

How To Contact Tech Support

The Rocket Money support team is available from Monday to Friday from 9 am to 8 pm EST. Unfortunately, there’s no phone number to call, but the team does have a live chat feature that you can access via the website or app to contact someone quickly when you have a question or need help. Look for the purple chat button in the lower right corner of the website or app to start a chat.

How To Cancel Rocket Money

Cancel Rocket Money by visiting the settings on the app or website when you’re logged into your account. Then, click on Premium, followed by Manage. From there, you can move the price slider to $0 and click Cancel Subscription.

If you’d like to delete your account completely, you can also do that by heading to your settings, clicking on Profile, and clicking on Delete My Account.

How Does Rocket Money Compare?

Rocket Money leans more toward subscription management and reducing overall spending rather than a budgeting-specific app, but it still has budgeting tools to help you stay on track.

| App Name | Cost | Free Trial | Type of Personal Budget | App Store Rating |

|---|---|---|---|---|

| Rocket Money | $4-$12 | Yes | Traditional budget | 4.2 |

| YNAB | $14.99-$99 | Yes | Zero-based budgeting | 4.8 |

| Goodbudget | $0-$10 | No | Envelope system | 4.6 |

| Monarch Money | $14.99-$99.99 | Yes | Zero-based budgeting | 4.9 |

| PocketGuard | $12.99-$74.99 | Yes | Zero-based budgeting | 4.6 |

| EveryDollar | $17.99-$79.99 | Yes | Zero-based budgeting | 4.7 |

| Quicken Simplifi | $47.88 | No | Multiple types of budgets | 4.1 |

| Honeydue | Free | No | Zero-based budgeting | 4.5 |

| Oportun | $0-$5 | Yes | Goal-based budgeting | 4.7 |

| Hiatus | $0-$10 | No | Goal-based budgeting | 4.2 |

Many users love Rocket Money because it offers more than the traditional budgeting app with its helpful subscription management and bill negotiation features, allowing users to slash some of their unnecessary expenses and reduce common bills.

Another bonus: You choose how much you pay for Rocket Money’s services. From a Premium account to bill negotiation, the user can select the amount they pay from a price range, making it easy to stay within your budget.

Is Rocket Money Worth It?

If you’re looking for a budgeting app that combines budgeting with subscription management to help you spend less money, Rocket Money is one of the best budgeting apps for the job.

With that said, Rocket Money’s free version doesn’t have a lot of exciting features other than some basic budgeting tools. To take advantage of Rocket Money’s best perks, like canceling subscriptions and lowering bills, you’ll need a Premium account. However, the ability to choose what you pay is a helpful feature that other budgeting apps don’t usually offer.

Is Rocket Money a scam?

No, Rocket Money is trusted by more than 5 million members and continues to be one of the most downloaded and highly rated budgeting apps on Google Play and the App Store. Rocket Money also uses 256-bit encryption to secure your data.

Does Rocket Money really lower bills?

Yes, Rocket Money can really lower your bills when you use its bill concierge service, which is available on a Premium account. Rocket Money has direct relationships with popular cable, cell phone, and internet companies, allowing them to negotiate your bills to a price you’re more comfortable with. The service comes with an additional fee of 30% to 60% of the amount Rocket Money helps you save.

Does Rocket Money really cancel subscriptions?

Yes, Rocket Money really cancels subscriptions that you’ve accidentally signed up for twice or no longer want. This happens through its subscription management service, which monitors your financial accounts for duplicate subscription transactions. Rocket Money alerts you when it finds a duplicate and asks you if you’d like to cancel the extra. It also keeps you updated with all your current subscription costs so you can decide whether you want to cancel any to save some money each month.

Does Rocket Money affect your credit score?

No, Rocket Money doesn’t affect your credit score. Rocket Money displays your credit score and updates it periodically, but this does not require a hard pull of your credit, so it won’t affect your score. You can monitor your credit score using Rocket Money whenever you’d like without affecting your credit.