Rocket Mortgage - 2025 Loan Guide

Formerly known as Quicken Loans, Rocket Mortgage is a lender offering mortgages to homebuyers. The company focuses on simplifying the process of getting a mortgage, with perks for customers like applying online, tracking the approval process, and finding a mortgage that matches a homebuyer’s needs.

About Rocket Mortgage

Rocket Mortgage is the largest mortgage lender in the United States, thanks to its dedication to routinely upgrading its offerings for modern homebuyers. Special programs help homebuyers finance their homes affordably, despite inflation and socioeconomic factors. The company also offers a wide range of mortgage products, like financing for manufactured and fixed-rate home equity loans, to fit virtually any homebuyer’s financial situation.

👍

Pros

- Serves all 50 states

- Offers a wide variety of loan products

- Customer service available 7 days a week

- JD Power Award: No 1. In Customer Satisfaction for Mortgage Origination

- App available on Google Play and Apple App stores

👎

Cons

- No brick-and-mortar locations

- No Home Equity Line of Credit/HELOC option

- No USDA loans

Types of Loans: FHA Loans, Jumbo Loans, VA Loans, Conventional Loans, Refinance Loans

Minimum Down Payment: 3%

Minimum Credit Score: 580

Why We Like Rocket Mortgage

Rocket Mortgage is a versatile lender with a mission to help as many types of homebuyers as possible secure a mortgage that works for them, whether they buy and flip real estate or are looking into homeownership for the first time. With a simplified mortgage process, preapprovals, and multiple home loan options, Rocket Mortgage is a mortgage lender that puts homebuyers first.

As one of the best mortgage lenders, Rocket Mortgage’s competitors include:

- Freedom Mortgage

- Fairway Independent Mortgage Corporation

- Better Mortgage

- Veterans United Home Loans

- Navy Federal Credit Union

- New American Funding

- Bank of America

Available in all 50 states + Washington, DC

Rocket Mortgage serves homebuyers in all 50 states and the District of Columbia. However, mortgage options vary by lender, so not all products may be available where you live. You can use the Rocket Mortgage website to search for a nearby lender to learn more about potential loan options in your local mortgage industry.

With its high customer satisfaction rates, it’s clear that homebuyers like what Rocket Mortgage offers and consider it one of the best mortgage lenders. Some of the most popular benefits are its helpful customer service, competitive mortgage rates, various types of home loans, and ability to complete an entire mortgage application online.

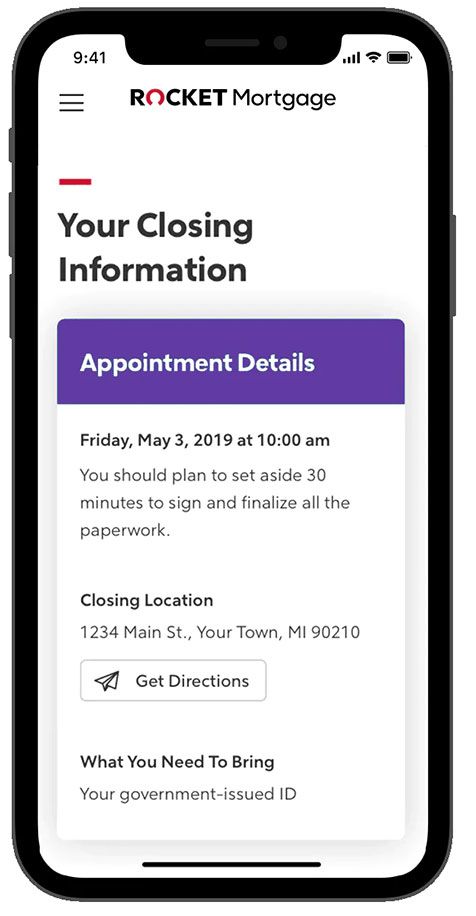

We also like the Rocket Mortgage mobile app (iOs, Android), which lets you track the progress of your mortgage application and get help along the way. Once a mortgage is approved, you can use the app to make payments on your loan, view your documents, get home estimates, or apply to refinance your home.

Rocket Companies offers additional services to help homebuyers save money on everyday costs, like Rocket Auto for car buying, and Rocket Loans for personal loans and debt consolidation products.

Types of Rocket Loans

Rocket Mortgage customers can choose from a variety of loan types based on their specific home-buying needs. These Rocket products vary by lender, so you’ll need to check with local lenders to see what Rocket Mortgage products are available.

15-Year and 30-Year Fixed Loans

Minimum credit score to qualify: 620

A fixed-rate mortgage loan is one with a fixed interest rate that won’t change over time. These loans can be more predictable in terms of repayment, allowing you to keep your mortgage payment relatively the same from year to year, even if market rates go up. Rocket Mortgage has loans for 15 and 30 years, with 30-year loans providing the lowest monthly payments and 15-year loans helping you pay off your mortgage faster.

Some of these loans may require mortgage insurance if you make a down payment of less than 10%, but this varies by lender.

Fixed Rocket loans offer some of the best Rocket Mortgage rates for various types of homes, including single-family residences and manufactured homes. There are also no prepayment penalties incurred if you decide to pay off your mortgage early.

Adjustable Rate Mortgages

Minimum credit score to qualify: 620

Adjustable-rate mortgages are another type of conventional loan offered by Rocket Mortgage. Unlike fixed-rate loans, these mortgages have varying interest rates that go up or down based on industry rates. However, your adjustable-rate mortgage comes with a fixed period during which your interest rate won’t move, and many loans have a low introductory interest rate during the fixed period. These loans are usually best for homebuyers who don’t plan on staying in their home long-term or plan to pay off their mortgage early.

Rocket Mortgage has a few different adjustable rate mortgage options to fit different situations. For example, a 7/6 ARM has a seven-year fixed period with adjustments as frequent as every six months after that period. On the other hand, a 10/6 ARM gives 10 years of fixed payments before switching to adjustments every six months.

FHA Loans

Minimum credit score to qualify: 580

Borrowers with a credit score of 580 minimum may qualify for an FHA loan through Rocket Mortgage. This loan type is best for buyers who don’t have a lot of extra cash for a down payment, as it only requires a minimum of 3.5% of the sales price. In exchange for a lower down payment, the loan places mortgage insurance on the loan for 1.75% of the loan amount and a monthly insurance premium.

Rocket Mortgage offers these loans as 15 or 30-year options with a fixed or adjustable interest rate to suit each borrower’s needs. Homebuyers should be aware, though, that they’ll need to pay up to 6% of the home’s purchase price as closing costs in addition to their down payment.

Jumbo Loans

Minimum credit score to qualify: 680

Jumbo loans from Rocket Mortgage are for homes with high purchase prices. Borrowers can get a jumbo loan for as much as $2.5 million if they have a minimum credit score of 680, a debt-to-income ratio of less than 45%, and can pay 2%-6% in closing costs.

Borrowers often use jumbo loans when they’re buying investment properties, like an apartment building, that cost more than the loan amount a conventional mortgage allows. However, you can also use this loan for a primary or secondary home, like a vacation home.

One benefit of a jumbo loan is that it usually requires less paperwork for the verified approval process than other loan types, so you could get your mortgage in your hands sooner.

VA Loans

Minimum credit score to qualify: 580

A VA loan through Rocket Mortgage gives veterans a more affordable and better way to own a home. These loans are specifically designed for veterans and current members of the armed forces, giving them lower-than-average interest rates and the chance to own their homes with no money down. VA loans are available as 15-year or 30-year fixed loans or jumbo loans.

VA loans also require a lower credit score than traditional loans at 580 minimum. However, veterans may need to pay a one-time funding fee for their loans and have a debt-to-income ratio of less than 60%.

Homeowners with a VA loan can also use the VA loan program to refinance their current loan, getting up to 100% of their home’s equity in cash, if desired.

Refinance Loans

Minimum credit score to qualify: 580-620

If you want to tap into your home’s equity, change your loan type, or get a better interest rate on your mortgage, refinancing might be an excellent option. Rocket Mortgage works with homebuyers to give them a refinance loan based on their financial needs and goals. Refinance loans are available for VA loans, FHA loans, and other loan types offered by Rocket Mortgage, but each has its own set of credit score requirements:

- FHA loan refinancing: Minimum of 580, or 620 for a cash-out refinance loan

- VA loan refinancing: Minimum of 580, but 620 is required if you want to cash out your home’s entire equity

- Traditional loan refinancing: Minimum of 620, on average

Additionally, homeowners need a substantial amount of equity in their homes to refinance. For most refinance loans, at least 20% is necessary, but some highly qualified homeowners may be able to have less equity and still refinance.

Home Equity Loans

Minimum credit score to qualify: 760

Like a refinance loan, a home equity loan lets you get some of your home’s equity back in cash to pay credit card debt, consolidate other loans, or pay for home repairs or upgrades. It’s important to know that home equity loans are not mortgages. However, if you have a current mortgage, you may qualify for a home equity loan from Rocket Mortgage if you have enough equity and a high enough credit score.

Rocket Mortgage staggers its home equity loans based on a homeowner’s credit score. For scores of at least 680, homeowners must have at least 25% home equity. Homeowners with credit scores of 760 or higher only need to leave at least 10% equity in their home but can take out a loan for any excess.

How To Apply for a Rocket Home Loan

To begin applying for a Rocket home loan, you’ll need a Rocket Account. A Rocket Account lets you manage anything you have through Rocket companies, including a mortgage or auto loan. You can access your Rocket Account on the web or through the Rocket Mortgage app.

Click the “Apply for Home Purchase” button on the Rocket Mortgage website to begin the process. The site takes you through the steps to get pre-approved and create your Rocket Account, where you can continue applying for your mortgage, manage your loan, make payments, contact customer support, and more.

To get a mortgage pre-approval, Rocket Mortgage recommends that you have the following documents readily available during the application process:

- A photo ID card, like a driver’s license

- Your Social Security number

- Pay stubs or proof of income

- Bank statements

- List of monthly debts

- Landlord references

- Tax documents

- Investment account information

- Letters from anyone sending you cash gifts to help you secure your mortgage

After getting preapproved, Rocket Mortgage will continue the full approval process with you, during which you may need to send more documentation.

How To Contact Rocket Mortgage

Rocket Mortgage offers several ways for customers to get quick help from the company.

For help with an in-process or closed loan

Call: (800) 603-1955:

Monday - Friday: 8:30 a.m. - 9:00 p.m. ET

Saturday: 9:00 a.m. - 4:00 p.m. ET

For help with a new loan

Call: (800) 603-1955

Monday - Friday: 7:00 a.m. - midnight ET

Saturday: 9:00 a.m. - 8:00 p.m. ET

Sunday: 9:00 a.m. - 7:00 p.m. ET

Live chat is also available on weekdays from 7 am to midnight EST, and on weekends from 8 am to midnight EST.

If you’re applying for a loan and running into trouble, you can connect with a support representative by sharing your screen. They’ll be able to see where you are in the application process and assist you.

Is Rocket Mortgage Right for Me?

Customers across the U.S. prefer Rocket Mortgage for its easy, online pre-approval process, helpful customer service, and variety of mortgage loan types for various needs. Keep in mind that mortgage rates and final costs vary significantly by location, credit score, the size of your loan, and several other factors. Therefore, Rocket Mortgage may not always be the best option for your specific situation.

You can apply to Rocket Loans to get pre-approval. This process is like a mini mortgage application process, so it can give you a good idea of whether you like it enough to move forward. You can also call other lenders to learn more about their process before deciding on the best mortgage company for you.