Fairway Independent Mortgage Corporation - 2025 Lender Review

Fairway Independent Mortgage Corporation is a popular mortgage lender that offers a variety of home loan options to help customers finance their homes. The company is known for its competitive rates, fast loan processing times, and commitment to personalized customer service.

About Fairway Mortgage

Although its full title is Fairway Independent Mortgage Corporation, the company typically goes by Fairway Mortgage. This mortgage lender has been offering home loan options to homebuyers and homeowners since 1996. Fairway Mortgage provides several types of home loans to customers, including an FHA loan, jumbo loan, and USDA loan, in addition to conventional home loans.

Fairway Mortgage serves customers in all 50 states, including Washington, D.C. It also has more than 700 branch locations in all states except West Virginia, and over 9,000 employees ready to assist customers. Use the search tool to find a local branch.

👍

Pros

- Serves all 50 states

- More than 700 branches across the United States

- Option to download app on Google Play and Apple App Store

👎

Cons

- Doesn’t publish rates; must apply to apply to get personalized rate

- No Home Equity Line of Credit/HELOC option

- Loans are serviced by third-party lenders

Types of Loans: Conventional Loans, FHA Loans, Jumbo Loans, Physician Loans, Renovation Loans, Reverse Mortgage Loans, USDA Loans, VA Loans, Refinance Loans

Minimum Down Payment: 3%

Minimum Credit Score: 600 FHA and VA / 620 conventional / 660 Jumbo

Why We Like Fairway Independent Mortgage Corp.

As you look for a mortgage lender to help you with a current or upcoming home purchase, it can be difficult to distinguish between each company you research. However, Fairway Mortgage has a few perks for its customers that we appreciate, including its many types of home loans to choose from and its dedication to helping communities in need. For example, it currently works with the Milwaukee Brewers to encourage and support homeownership in Wisconsin by fighting poverty, food access challenges, and other financial roadblocks many people face.

As one of the best mortgage lenders, Fairway Mortgage’s competitors include:

- Freedom Mortgage

- Rocket Mortgage

- Better Mortgage

- Veterans United Home Loans

- Navy Federal Credit Union

- New American Funding

- Bank of America

Fairway Mortgage also continuously looks for ways to upgrade its loan options and home purchase processes for customers. For example, a relatively new program known as the Fairway Community AccessTM program (FCA) offers homebuyers in select areas up to $7,500 to help with the down payment and closing costs of buying their homes. It also elected a dedicated team to handle reverse mortgages to better assist homeowners with this type of loan product.

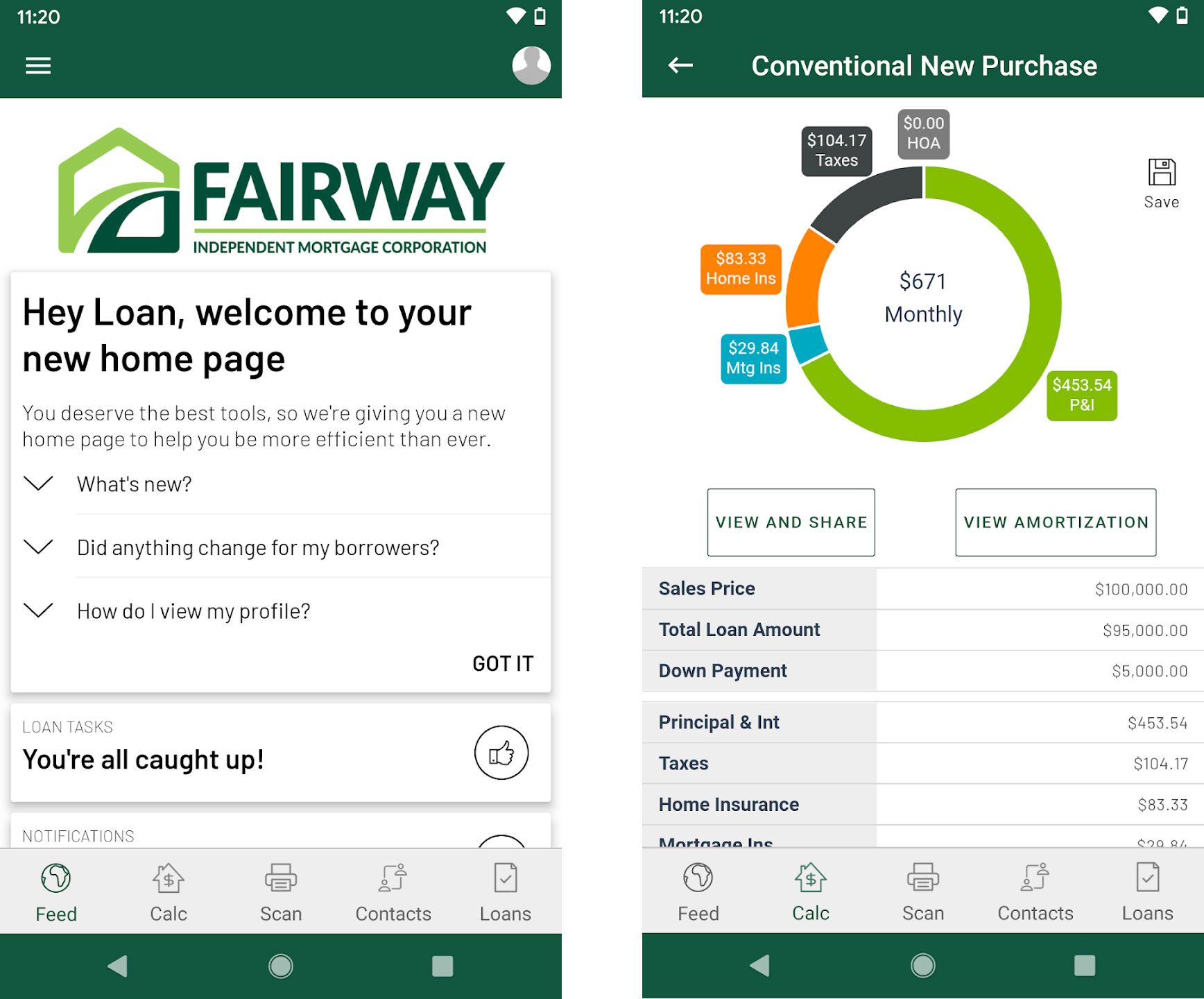

Fairway Mortgage’s mobile app is another benefit its customers have. The app includes helpful tools for you to plan your mortgage payments, find a home, get preapproved, submit documents, and more. It also allows for quick and convenient messaging between you and the lender, so you can get your questions answered fast.

Types of Loans

Fairway Mortgage has an extensive selection of mortgage loan options for homebuyers and current homeowners who want to refinance. The mortgage lender works with the VA, FHA, and USDA to offer loans to homebuyers with unique purchasing situations in addition to providing conventional loans for more general homebuying needs.

This guide discusses typical mortgage loans offered by Fairway Mortgage for people buying homes. However, we want to point out that the company also has renovation loans for homeowners seeking financing for home upgrades or repairs.

Adjustable and Fixed Rate Conventional Loans

Fairway Mortgage’s conventional loans are available as an adjustable-rate mortgage or a fixed-rate mortgage. Adjustable rate loans can vary after a loan period, while fixed-rate loans remain the same throughout the life of the loan. The latter may be the better option if you plan to stay in your home for a long time.

Down payments on these loans range from 3%-20%. However, homebuyers with down payments lower than 20% automatically have mortgage insurance added to their loans, which will be an additional payment tacked on each month. In some cases, buyers may be able to bundle their closing costs into their conventional loan or ask sellers to pay for some or all of the closing costs.

To get a conventional loan, homebuyers need a minimum credit score of 620. They also should have a stable income source for the best chances of qualifying.

FHA Loans

An FHA loan through Fairway Mortgage is best for homebuyers with credit scores of 580 or above. Although these loans do have lower credit score requirements, a homebuyer may not be able to qualify with bad credit or negative marks on their credit report. Rather, FHA loans are designed to help more people buy a home, even if they wouldn’t qualify for a conventional loan.

Fairway Mortgage allows some multi-unit properties to be bought with FHA loans, and homebuyers can choose between fixed or adjustable-rate mortgages to fit their needs. One benefit of FHA loans is that they have lower-than-average down payment requirements. However, mortgage insurance is often required for down payments of less than 10%. FHA loans can be refinanced into another FHA loan or a conventional loan when homeowners reach enough equity in their homes.

Jumbo Mortgage Loans

Fairway Mortgage offers jumbo mortgage loans to homebuyers who are purchasing homes that cost more than allowable limits for conventional loans. These are typically homes that cost $800,000 or more. Because more money is being financed, jumbo loans may take longer to secure, as the underwriting process involves more steps with extra requirements compared to conventional loans.

Similarly, homebuyers should expect to have higher credit scores than necessary for a conventional loan and other loan types. In most cases, a minimum credit score of 680 is necessary, although this can increase with larger loans. Down payments are at least 10% for jumbo loans through Fairway Mortgage.

One caveat to consider with a jumbo loan is that your interest rate may be higher than with a conventional loan. However, you can choose between adjustable rates and fixed rates for your mortgage.

Reverse Mortgage Loans

Reverse mortgages are a unique type of loan that not all lenders offer. Borrowers who are at least 62 years old can apply for one through Fairway Mortgage. These loans tap into a home’s equity to give homeowners money they can use toward other expenses. Retirement is a good time for homeowners to consider using a reverse mortgage loan, especially if they don’t have a lot of money saved elsewhere.

Usually, a homebuyer needs about 50% equity in their home to qualify for this type of loan. They should also have a good credit history, no delinquent federal debt, and live in the home as their primary residence. Reverse mortgages can be used to refinance the current mortgage, pay medical debts or health insurance payments, or get tax-free money for other large purchases or long-term payments.

Refinance Loans

Refinance loans through Fairway Mortgage help homebuyers reduce their interest rates on their current loans or reconfigure their loan terms. Usually, homebuyers do this to lower their monthly mortgage payments. However, you can also use a refinance loan to turn your home’s equity into cash to use for other purchases.

Because refinance loans can vary so much between different buyers, their credit requirements also vary. Requirements are also influenced by the type of loan a homeowner already has and the type of refinance loan desired. For example, an FHA homeowner can refinance to a conventional loan, but the process will require a higher credit score and lower debt-to-income ratio than when they first applied for an FHA loan.

Homebuyers who are interested in refinancing through Fairway Mortgage can learn more about the process based on their specific situation by contacting a Fairway Mortgage representative.

USDA Loans

USDA loans are for prospective homebuyers in eligible rural areas. These loans do not have as flexible terms as other loans, only allowing borrowers to get a loan for 30 years and fixed mortgage rates. However, this loan type is typically for people with lower incomes who may otherwise have a financial hurdle to buy a home. Therefore, the USDA allows some mortgage borrowers to get a loan with no down payment or a low down payment.

Borrowers getting a USDA loan with Fairway Mortgage can finance up to 100% of the appraised value of a home. Homebuyers should have a minimum credit score of 640.

VA Mortgage Loans

Fairway Mortgage helps people who are eligible for VA loans borrow the money they need for their homes. The VA backs these loans, but service members and veterans must go through an approved lender to apply for a VA mortgage loan.

VA loans are some of the best loan products for people seeking an affordable way to own a home. These loans do not charge mortgage insurance and have lower down payment requirements than a conventional mortgage. Credit report and score requirements are also lower, usually requiring a minimum credit score of 580. These loans are known for their smooth loan process, creating a straight path toward homeownership for current and former service members.

Physician Loans

Fairway Mortgage provides a unique loan option to medical professionals who want to own a home. The company’s physician loans are specifically for medical professionals, who often have high debt-to-income ratios that could interfere with their ability to own a home. These physician loans consider each borrower’s financial picture more holistically than conventional loans, providing medical professionals with an opportunity to purchase their dream home.

There is no strict credit score for these loans. However, the lender will consider things like your student loan debt, how soon you expect to graduate, and how much of a down payment you can afford to determine whether you’re a fit for this loan type.

How To Apply for a Fairway Mortgage Home Loan

To get started with a Fairway Independent Mortgage application, you can use the online tool to prequalify. The tool asks you a few questions to learn about your mortgage needs and does not impact your credit score. After completing the questionnaire, the company will reach out to you to talk about your mortgage options and related financial services that might help.

You can also sign up for FairwayNow, the company’s mobile app for iOS and Android devices. It lets you apply for preapproval and check the status of your application directly from your device. After approval, you can use it to make payments, contact a loan officer, and upload documentation.

How To Contact Fairway Independent Mortgage Corp.

Fairway Mortgage is available to contact Monday through Friday from 8:30 am to 5 pm Central.

Call 877-699-0353 during business hours or email customerservice@fairwaymc.com for non-urgent questions. You can also send secure messages about your account via the FairwayNow app.

After the Loan Closes

Once your Fairway Mortgage loan closes and you’re an official homeowner, it will soon be time to make the first payment on your mortgage. You can view your account on the Fairway Mortgage website or via the FairwayNow app. Both options show you your loan information, including your escrow account details, and the amount you owe. You can pay conveniently through the website or app.

Over the life of your loan, your mortgage may transfer to another loan servicer. This is a normal part of the mortgage process. If that happens, continue making any payments due to Fairway Mortgage until you’re told to begin paying the new loan servicer. Fairway Mortgage and your new loan servicer will send you information by mail to make you aware of the process and what to expect.

Is Fairway Independent Mortgage Corp. Right for Me?

Fairway Mortgage provides several mortgage loan options for home buyers, whether you qualify for a conventional loan or need something more specific to your situation. We recommend reaching out to Fairway Mortgage as you research the best mortgage providers to compare it to other lenders. You can always apply for a preapproval, too, to see what options you have as you move further in the home-buying process.

Download the FairwayNow app from the Apple App Store or Google Play to apply quickly and conveniently on your mobile device.