Monarch Money Is a Good Budgeting App for Couples, But What If You're Single?

When you have multiple bills, several financial accounts, and investment accounts to keep track of, it’s easy to have something get lost in the shuffle. Using a personal budgeting app like Monarch Money can store all your financial information conveniently on your device, giving you a glimpse into your current and future finances.

Monarch Overview

Also known as Monarch Money, Monarch is a relative newcomer to the personal budgeting scene, launching its app in 2021. Despite being only a few years old, Monarch has grown exponentially since its launch, with more than 100,000 downloads on Google Play alone.

The company, whose mission is to help people create healthy personal finance habits with convenient digital tools, was founded by startup experts with backgrounds in engineering and design.

Monarch is designed for both regular people who want to improve their budgeting and expense tracking and personal advisors who want a customer-focused way to provide their clients with easy-to-use budgeting tools.

Why We Like Monarch Money

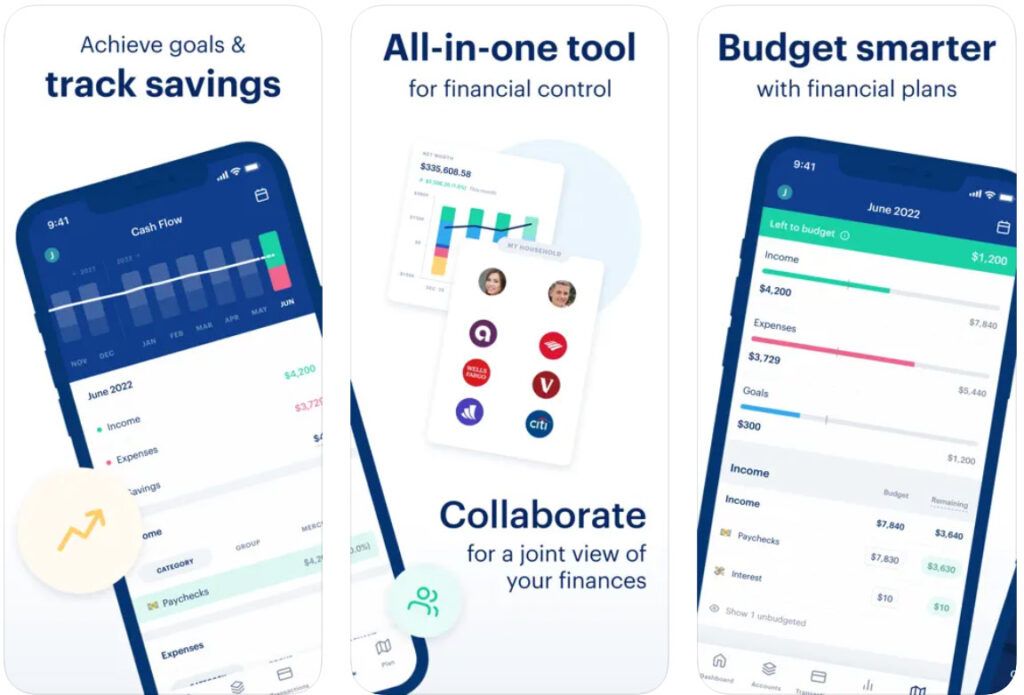

Monarch is more collaborative than other budgeting apps, allowing you to either work on your budget with a partner or someone else you trust or collaborate with your financial advisor using the app’s tools, reports, investment tracking, and more. Syncing financial accounts to one Monarch account is easy, and doing so keeps all your information in one place to check whenever you’d like from different devices.

We also like Monarch Money’s dedication to investments rather than just tracking your current income and expenses. The app analyzes your investment portfolio and shows you how specific investments stack up against others. When you use Monarch, you’re learning how to spend less money and grow your financial wealth.

Who Is Monarch Money Best For?

Monarch is best for people who want a simple way to budget and keep on top of their finances without feeling overwhelmed. It can be especially helpful for those looking for ways to cut unnecessary expenses, as it notifies you of all upcoming bills and subscriptions so you can visualize where your money goes and when.

This app is also a good choice for couples, friends, or family who want to budget together. You can sync all your bank accounts to one Monarch account so that together you can view your finances, bills, and reports – yet you’ll each get a separate login to keep your settings and sensitive information to yourself.

Plans and Pricing

Monarch Money has a free 7-day trial that lets you experience all of its premium features for a full week before committing to a subscription. However, to get the most out of Monarch Money, you’ll need to upgrade to a subscription costing $14.99 per month or $99.99 for a full year.

| Plan | Price | Features |

|---|---|---|

| Free Trial | 7 days | Full access to premium features |

| Monthly | $14.99 | Full features including bank links, investment tracking, custom categories, and financial reports |

| Annual | $99.99 | Same as monthly, better value |

The premium plan gives you access to everything you probably downloaded Monarch for, like linking your bank accounts, tracking investments, creating custom categories for transactions, viewing custom financial reports, and more. You’ll also get alerts for your recurring bills and subscriptions so you can stay ahead.

Occasionally, Monarch offers specials for longer, 30-day free trials so prospective customers can spend even more time with the app before buying it.

How Monarch Money Works

Monarch Money uses a zero-based budgeting system, one of the best types of personal budgets for people who like to have a plan for all their income each month. Once you set up your financial accounts, the app syncs your transactions and income, so you’ll know exactly how much you can save toward your goals and spend in key areas, like bills and groceries.

Here’s how Monarch Money works for budgeting, tracking your investments, and collaborating with others.

Budgeting with Monarch Money

Although Monarch aligns with zero-based budgeting by default, you can essentially create whatever custom budget you’d like to keep yourself on top of your finances. Monarch leaves space for both monthly and annual budgeting so you can see your progress for short and long-term savings goals. Every aspect of the budget is customizable, from spending categories to spending groups. The app also has calculators to help you see how changing your spending or savings routine could impact your finances.

Monarch’s calendar is another helpful budgeting feature that digitizes due dates for your bills and recurring subscriptions. This makes it easier to stay on top of things you pay for more spread out, like subscriptions that recur every six months or year. Be sure to turn notifications on for the Monarch Money app to get alerts for upcoming due dates and subscription renewals.

Net Worth and Investing with Monarch

Plan for your future finances as much as you control your current ones using Monarch Money’s net worth and investment tools.

The net worth feature tracks your estimated net worth over time by analyzing your connected financial accounts and reports your totals using an easy-to-read graph. You’ll also get breakdowns of your net worth and liabilities in specific categories, like investments and student loan debt.

If you have multiple investments, you can get an overview of all of them in the app after connecting your accounts. Track your stock market gains and losses, current values, number of shares, and more while viewing a simplified graph illustrating your investments’ movement over time.

Good News for Single People

It’s okay if you’re single – Monarch Money is designed to be used solo so you have complete control over your budget and goals. You can also team up with a partner and keep track of your finances together.

How Collaborating Works With Monarch

Collaboration is available with a paid subscription, and the account holder controls who gets invited to the account. Once you invite someone, they’ll have a separate login so you can keep your account and profile 100% secure.

Shared budgeting allows each of you to add the financial accounts you want to share – like your joint bank accounts or your separate retirement accounts, so both of you can view them. You can also create shared savings goals to monitor and tweak as you see fit.

This feature is also designed to work well with financial advisors to help their clients be more hands-on with their finances.

How To Sign Up for Monarch Money

You can sign up for Monarch Money on its website to start your free 7-day trial. Sign up using your email address or with your Google or Apple account. You can also download the app on the App Store or Google Play and sign up through the app. Follow the setup to create your account and begin your free trial.

How To Contact Monarch Support

If you have a problem with your Monarch Money account or app, reach out to the support team by emailing support@monarchmoney.com. Or directly message the company on X (formerly Twitter).

For general questions or to learn how Monarch Money works, consider using its help center, which has a range of helpful articles that teach you how to navigate each feature. If you can’t find the information you need, you can submit a request via the help center for the support team to respond to.

How To Cancel Monarch Money

From the website, go to your account settings and find the subscriptions area. From here, you should see a link to cancel your subscription.

If you want to cancel Monarch Money from the app instead, go to your app store’s settings. Look for your subscriptions and find your Monarch Money subscription to cancel it.

How Does Monarch Compare?

Monarch Money is one of the best budgeting apps for couples and financial advisors. You can share your budget without risking your personal account information to help you and another person stay on track with your finances.

| App Name | Cost | Free Trial | Type of Personal Budget | App Store Rating |

|---|---|---|---|---|

| Rocket Money | $4-$12 | Yes | Traditional budget | 4.2 |

| YNAB | $14.99-$99 | Yes | Zero-based budgeting | 4.8 |

| Goodbudget | $0-$10 | No | Envelope system | 4.6 |

| Monarch Money | $14.99-$99.99 | Yes | Zero-based budgeting | 4.9 |

| PocketGuard | $12.99-$74.99 | Yes | Zero-based budgeting | 4.6 |

| EveryDollar | $17.99-$79.99 | Yes | Zero-based budgeting | 4.7 |

| Quicken Simplifi | $47.88 | No | Multiple types of budgets | 4.1 |

| Honeydue | Free | No | Zero-based budgeting | 4.5 |

| Oportun | $0-$5 | Yes | Goal-based budgeting | 4.7 |

| Hiatus | $0-$10 | No | Goal-based budgeting | 4.2 |

However, it is a bit pricier than other options at $14.99 per month or $99 for an annual subscription. And, with a standard 7-day free trial, you don’t get as much time to try out the app before jumping into a paid subscription as you might with other budgeting apps.

Is Monarch Money Worth It?

Although Monarch is in the upper price range of budgeting apps, it could be a worthy investment for someone looking to monitor their entire financial picture. While some apps don’t track investments or clue you into your net worth, Monarch does while also giving you access to typical budgeting and spending tools to manage your current finances and build wealth over time.

Monarch is a good app for single people, but it offers more value if you’re interested in collaborative budgeting with your partner, or want a tool that you and your financial advisor can use together. Its collaborative design keeps logins separate but gives both of you access to everything you need to connect accounts and share financial goals.

Is Monarch Money legit?

Yes, Monarch Money is a legitimate app to use for budgeting and financial planning. In fact, many Mint users have switched over to Monarch Money after Mint announced its closure. Monarch Money is ideal for couples who share budgeting goals and financial advisors who want to use its tools to educate their clients.

What banks does Monarch Money support?

Monarch Money connects to many of the most popular banking systems, including Chase, Wells Fargo, Discover, and Fidelity. It also continues to add more banks and update connections to improve user experiences and compatibility.

Does Monarch Money have a free version?

Monarch Money does not have a technical free version of its app that you can use at all times if you don’t want to upgrade. However, all users can start with a 7-day free trial to test its features and determine whether it’s the right app for them. Monarch Money also sometimes releases 30-day free trials, giving you even more time to use the app before upgrading.

Does Monarch Money track crypto?

Yes, Monarch Money can connect to Coinbase to track your cryptocurrency investments. Once connected to your Coinbase account, you can view the value of your investments in real-time. Monarch Money refreshes your Coinbase account information every couple of minutes so you can have the most accurate data at your fingertips.

Does Monarch Money have a desktop version?

Yes, when you’re on a desktop computer, you can visit app.monarchmoney.com/login with your browser. When you do, you’ll have access to all the same tools you use on the Android or Apple app, including bank connections, reporting, investment tracking, and sharing your budget with another user.

How safe is Monarch Money?

Monarch Money uses Plaid and Finicity to connect your bank accounts to its platform. These data providers are reputable and trusted in the financial industry, as they use bank-level encryption to secure your financial data. To keep your account information locked down, Monarch Money allows multi-factor authentication for higher login security.