Allstate Umbrella Insurance - View Coverage Options for 2025

Umbrella insurance offers extra protection to people who already have insurance coverage for their vehicles and homes. Personal umbrella insurance extends the coverage of a traditional auto insurance or homeowners insurance policy, providing higher coverage limits if an event occurs that requires more coverage than the customer’s other policies include.

An Allstate umbrella policy is one of the most popular in the industry, along with its other reputable coverages, like liability insurance, flood insurance, and renters insurance. Allstate Insurance Company has existed since the 1930s and continues to provide multiple coverage options for virtually every protection need. Adding an Allstate umbrella insurance policy to your list of coverages can be an affordable way to make the most out of your insurance coverage and protect what matters most.

Allstate - Company Overview

Founded in 1931, Allstate Insurance Company has focused on simple and affordable coverage for consumers and businesses. Today, the insurance company offers multiple types of protection, including umbrella coverage, car insurance, personal liability coverage, insurance for renters, landlord insurance, and disaster insurance coverage. Although the company is not yet accredited by the Better Business Bureau, it has an A+ rating.

👍

Pros

- Coverage extends to domestic and international travel

- Protects boating and recreational vehicles—no matter whether you rent or own

- Offers a range of policy limits at affordable rates

👎

Cons

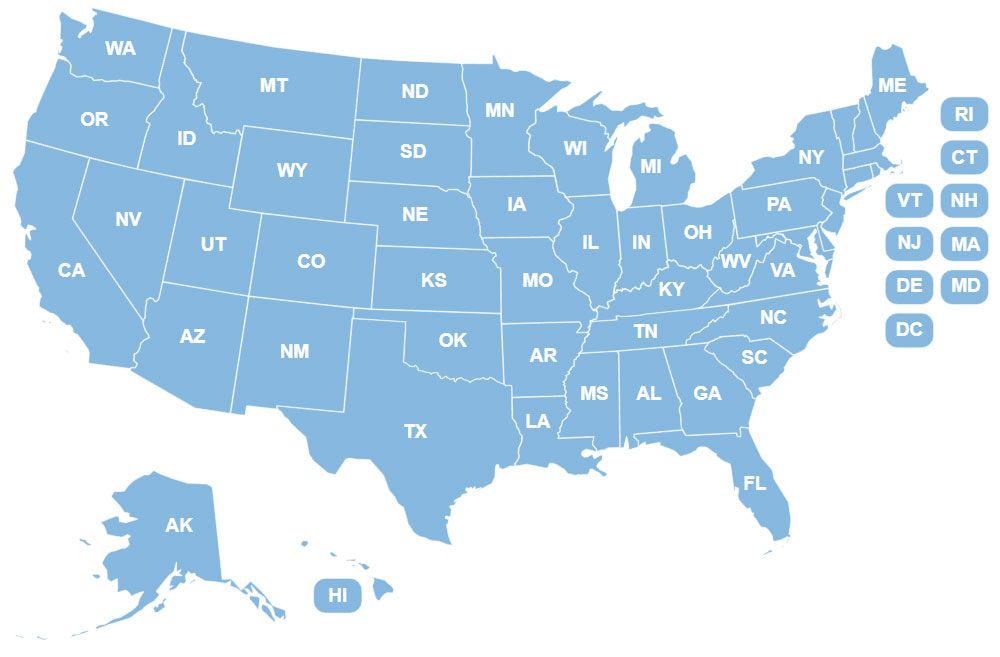

- Limited to 42 states and Washington D.C.

- Coverage limit can be prohibitive for high income policyholders compared to other insurance companies

Coverage Limit: $1-5 million

Multi-policy Discounts Available: Yes

Minimum Home Insurance Requirements: $300k liability coverage

Minimum Auto Insurance Requirements: $250k bodily injury liability per person, $500k bodily injury liability per accident, $100k properly damage liability OR $500k combined single limit

Allstate offers insurance coverage in all 50 states and the District of Columbia, although some specific types of policies may not be available in every state. Through its network of agents, customers can get help finding a homeowners insurance policy or personal umbrella policy that fits their needs without going over their budget.

Over the years, Allstate has won numerous awards, including Outstanding Business from the Global Business Excellence Awards and recognition as a CIO 100 winner for its Good Hands Rescue service, which offers 24/7 roadside assistance with a convenient online request form.

Allstate is also known for its charitable spirit, donating millions of dollars in economic opportunity grants and supporting domestic violence survivors through financial empowerment.

As one of the best umbrella insurance providers, competitors of Allstate include:

- Geico Umbrella Insurance

- Liberty Mutual Umbrella Insurance

- Chubb Umbrella Insurance

- The Hartford Umbrella Insurance

Why We Like Allstate’s Umbrella Policy

Allstate Insurance Company is perhaps most well-known as an insurer for homeowners, auto, and life insurance. However, the Allstate umbrella policy shouldn’t be overlooked, especially if you already have another Allstate insurance policy.

With umbrella policy coverage limits of up to $5 million, Allstate can offer additional protections to almost any insured consumer. Although it does require minimum coverage limits for bodily injury liability coverage and property damage liability, Allstate provides consumers with a comprehensive range of umbrella policy limits to help you customize your coverage.

Allstate umbrella insurance is also cost-effective for many, with policies typically not exceeding about $300 a year, which equates to just $25 a month. Of course, you may need to bump up your homeowners insurance coverages to meet the minimums, which could add to your overall costs for insurance.

If there’s one con, it’s that Allstate umbrella insurance isn’t available in all states. Although only eight states are left out, it can be disappointing to be an Allstate customer who wants to sign up for an umbrella policy only to learn that coverage isn’t available to you.

What Is Umbrella Insurance?

Umbrella insurance is additional insurance coverage that extends the coverage limit of other insurance policies, usually auto and homeowners’ insurance. Think of it like an actual umbrella. You have your typical auto and home insurance policy under the umbrella, while your umbrella insurance offers an extended layer of protection over those policies.

Umbrella insurance is usually thought of as coverage that protects only high-income policyholders or people with lots of assets to protect. Although homeowners with a large number of assets can certainly benefit from an umbrella policy, so can people with a more common number of assets and a more traditional income. That’s because personal umbrella policies can offer extra coverage for events that can happen to anyone that your regular insurance doesn’t cover.

Another benefit of umbrella insurance is its ability to act as extended personal liability insurance. For example, if a delivery driver falls on your steps while delivering packages to your home and sustains serious injuries, your homeowners’ insurance steps in first for coverage of their medical bills and, if necessary, a lawsuit. However, your home insurance liability protection may not offer enough coverage, but your extra umbrella insurance can lay an additional blanket of personal liability insurance over your policy to protect you and your assets.

How an Allstate Umbrella Policy Works

An Allstate umbrella policy works similarly to that of other insurance companies. These policies are entirely optional, but you’re required to have homeowners’ or auto insurance with Allstate to have one. You can also have additional policies, like motorcycle or boat insurance.

Depending on the type of policy you have, your policy must meet specific coverage minimums for you to add an umbrella policy to it. For example, a primary residence must have at least $300,000 per occurrence for its liability limit minimum, while a recreational vehicle policy must have bodily injury liability coverage of at least $100,000 for each person and $300,000 for each accident.

When you sign up for an umbrella policy through Allstate Insurance, your policy will begin covering you from the policy start date.

Allstate Umbrella Insurance Coverage and Limitations

When you sign up for Allstate umbrella insurance, it’s not just you that your policy protects; the other members of your household also get protection under your umbrella policy. Some exceptions apply to this, like if your spouse has their own auto insurance policy or has insurance through an insurer other than Allstate.

Your policy covers you for various liability claim situations, like if someone were to sue you for a negative business review you wrote online or if a neighborhood child playing in your yard with your child falls off a slide and gets injured. Your homeowners’ insurance typically covers a portion of these types of incidents, but it may not have all of the coverage you need to cover medical bills or legal costs.

As with any insurance policy, an Allstate umbrella policy also has some exclusions and limitations. For example, if you run a business out of your home, anything related to your business may not be covered. So, if a client falls down the steps when leaving your home, your umbrella coverage may not apply because the client is related to your business, not your actual home. You’ll need business insurance for this type of situation.

Also, your umbrella coverage can’t cover legal fees for something that occurred outside of the time your policy was in effect. So, if you bought your policy in June and were being sued in August for an online review you wrote in April, your policy wouldn’t cover it because you wrote the review before your policy went into effect.

How Much Does Allstate Umbrella Policy Cost?

In most cases, an Allstate umbrella policy costs $100 to $300 per year, which is as low as around $8 to $25 per month. How much your policy costs will depend on the amount of coverage you want and the amount of coverage you have on your other required insurance plans.

For example, if you have the maximum allowed amounts on your homeowners insurance and auto insurance, the cost for your umbrella policy will likely be on the lower end of the spectrum. However, adding maximum coverage to your umbrella policy can increase your costs. Be aware that your location and claims history can also factor into the cost of your umbrella policy from Allstate.

How To Get Started with Allstate Umbrella Insurance

Unlike its other insurances, Allstate doesn’t have an online quoting system for an umbrella policy. Instead, you’ll need to call 866-614-3800 to get a quote by phone. This is because an Allstate representative needs to look at the details of your other policies to give you an accurate quote for umbrella insurance.

Have your policy numbers that will be associated with your umbrella coverage available to give the agent. You can find these on your policy documents.

Also, look through your current coverages to see if you have the minimum amount of coverage needed for an umbrella policy, like $300,000 per occurrence in liability coverage on your homeowners’ insurance. If not, the representative can give you a quote that includes necessary adjustments to your other policies so that you can get an umbrella policy.

How To Submit an Allstate Umbrella Policy Claim

Once you have an umbrella policy with Allstate, you can log into your online account to submit a claim online. This is usually the fastest and easiest way to submit and track a claim. Be sure to check in on your claim to see if Allstate needs any additional information or documentation before it can process your claim.

Alternatively, call 800-255-7828 to speak with a representative who can answer your questions or help you submit a claim.

How To Cancel an Allstate Umbrella Policy

The easiest way to cancel your Allstate umbrella policy is to call Allstate’s customer service department at 800-726-6033 to speak with an agent. Or, if you use an agent, contact your agent directly for help. You can also reach out to Allstate’s customer support via live chat on the Allstate website.

If you currently have any claims against your insurance policies that your umbrella policy covers, you may not be able to cancel your policy until those claims have been processed.

Customer Service Contact Info

Allstate offers a few ways for customers to contact an agent for help. You can quickly get help with your policy, ask questions about a quote, and have a support rep assist you with a claim. If you have an Allstate agent, you can reach out to them directly for help with your policy or getting your questions answered. Otherwise, log into your Allstate online account to chat with a representative or find phone numbers specific to the issue you have.

Here are a few contact methods and links to keep handy:

- General customer service: 800-726-6033

- Allstate claims assistance: 800-255-7828

- Allstate agent locator

- Allstate customer service email

- Allstate’s Twitter account, which you can tweet with general questions

- Allstate mobile app, which includes customer service information

Allstate Umbrella Policy FAQs

The following are a few common questions people ask about an Allstate umbrella policy that could help you decide whether this type of policy is right for you.

Do I need an umbrella policy?

If you own or rent a home or vehicle, an umbrella policy is usually a good idea, even if you don’t have a lot of assets to cover. Accidents happen, and when they do, they can cost much more in property damage and liability than your insurance policies cover. With umbrella insurance, you won’t have to worry about those what-ifs.

How much umbrella coverage should I get?

Umbrella insurance coverage can go as high as $5 million. Minimum coverage is often around $1 million. Consider the assets you have to cover, and always choose coverage that will exceed your assets. Umbrella coverage is relatively inexpensive, even with the highest coverage limits, so it’s best to get the highest coverage you can reasonably afford.

Does Allstate umbrella insurance cover renters or just homeowners?

An Allstate umbrella policy can also cover renters just like it would homeowners. If you have a renters policy, you can get umbrella coverage for extra protection in the event that you’re found liable for an accident.

What are the disadvantages of umbrella insurance?

The one downside to umbrella insurance is that you need to meet minimum coverage requirements for the policies your umbrella insurance is connected to. Adding coverage will boost your premiums, which can sometimes put costs out of an affordable range for policyholders.

Are Allstate umbrella insurance claims easy to submit?

Yes – Allstate makes its claims process simple for customers by allowing digital submissions via its website or mobile app. You can also call Allstate or your agent to help you through the claims process.

Is an Allstate Umbrella Policy Worth It?

Now that you know what an Allstate umbrella policy is and how umbrella coverage works, your next question is probably, “Is an Allstate umbrella policy worth it for me?”

Our answer for most is yes.

A personal umbrella policy from Allstate is a good idea, even for people who don’t have many assets to cover. If an incident occurs that your auto or homeowners’ insurance doesn’t fully cover, you’ll be left paying out of pocket for any additional costs. With umbrella insurance, you’ll rarely need to worry about not having enough coverage when an unexpected event happens.

Like Allstate’s other coverage options, its umbrella policies are easy to manage and update when needed simply by logging into your online account or contacting your agent to make changes. You can also conveniently submit claims online or speak with an Allstate agent about your policy within minutes via live chat.

Consider getting a quote from Allstate to get an idea of how much you’ll pay between your homeowners insurance, auto insurance, and umbrella policy. It’s free, and you can get your policy started as soon as you accept your quote.