Brigit Review (2025): A Cash Advance App That Helps You Manage Your Money

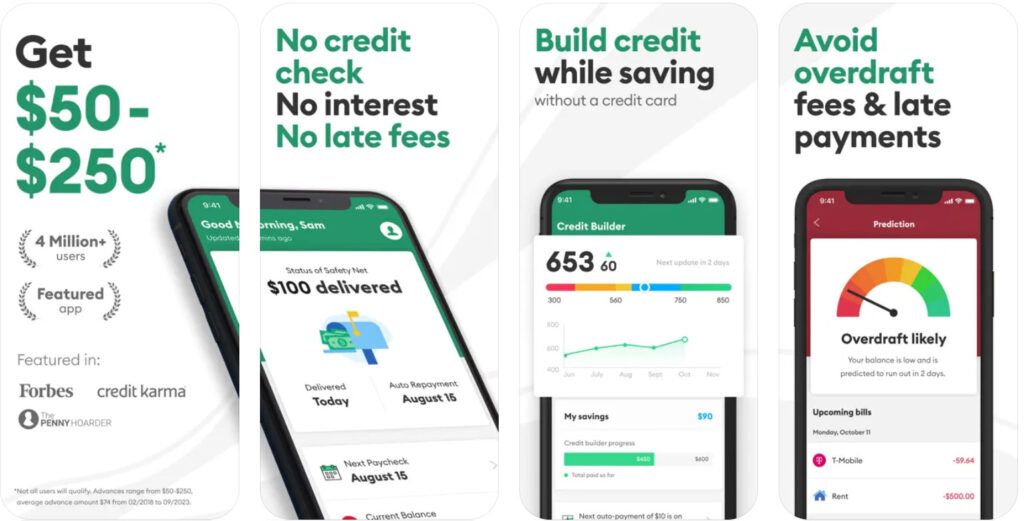

Brigit is a well-known cash advance app that lets you borrow up to $250 without paying interest. It also has other nifty features to help you budget and build your credit. However, the company has been in hot water with the FTC over undisclosed fees. So, it’s important to know how the Brigit app works to decide if it’s right for you.

Our Brigit review is covering its features, fees, and how to ultimately decide if it’s worth it.

Brigit App: Overview

Brigit was founded by Zuben Mathews and Hamel Kothari and launched its app in 2017. They created Brigit to tackle common financial challenges like overdraft fees and cash flow issues. The app provides cash advances, budgeting tools, and credit monitoring services. Users can connect their bank accounts to track spending and improve their financial health.

👍

Pros

- Has useful budgeting tools

- Also helps you build your credit

- Simple pricing structure

- Brigit Premium members get some discounts

👎

Cons

- Expensive monthly membership plans

- Low cash advance limit versus some competitors

- Must be active for 60 days on Brigit before taking out an advance

Highlights

Cash Advance Limits: Up to $250 per pay period

Fees: $0.99 - $14.99

Credit Score Requirements: None

Is Brigit Legit?

Brigit is a legitimate company headquartered in New York. The company has been providing cash advances since 2019.

With over 7 million users, the Brigit app is incredibly popular and is considered to be one of the best cash advance apps on the market. It has 4.8 stars out of over 290 reviews on the iOS app store and 4.7 stars out of over 190K reviews on the Android app store.

However, it’s important to note that Brigit has been in trouble with the Federal Trade Commission (FTC) in the past. The FTC alleged that Brigit wasn’t clear on its fees or cash advance amounts in its advertising, which upset users. In November 2023, Brigit settled the complaint by agreeing to end its deceptive marketing tactics and paid $18 million in refunds to customers.

Brigit Cash Advances

Brigit offers cash advances between $50-$250 per pay period through its Instant Cash feature. There is no credit check required, and Brigit does not charge interest. Unlike many other cash advance apps, Brigit also does not have a tipping system.

| Details | Information |

|---|---|

| Cash Advance Limits | Up to $250 per pay period |

| Fees | $8.99 or $14.99 monthly subscription fee, $0.99 to $3.99 fast advance fee |

| Credit Score Requirements | None |

| Eligibility Requirements | Active checking account (60+ days), 3 recurring direct deposits, bank account balance > $0 |

Along with manual cash advance requests, Brigit users can take advantage of the app’s Auto Advance feature. When turned on, this feature allows Brigit to automatically deposit cash to your account when you’re at risk of an overdraft.

Standard cash advance transfers take 1-3 business days, but users can also opt to pay an extra fee between $0.99-$3.99 for Express Delivery to get their money within 20 minutes.

Brigit Cash Advance Requirements & Eligibility

Brigit does not run your credit to determine eligibility. However, users are required to meet several Brigit requirements.

To qualify for a Brigit cash advance, you must have:

- An active checking account at least 60 days old

- A minimum of 3 recurring direct deposits from the same source

- A bank account balance over $0

When you sign up, you must link your bank account. Then, Brigit will review your account activity and give you a score between 0-100. Brigit updates scores frequently, as much as twice each day.

You must have a score of at least 40 to be eligible for a Brigit cash advance. The higher the score, the larger your cash advance limit will be, up to $250.

Other Brigit Features & Perks

Along with cash advances, the Brigit app has lots of other useful features, including credit-builder loans, identity theft protection, budgeting tools, and a side gig finder.

| Feature | Description |

|---|---|

| Cash Advances | Up to $250, no interest, standard transfer in 1-3 days, express delivery available in under 20 minutes |

| Auto Advance | Automatically deposits cash to prevent overdrafts |

| Credit Builder | Interest-free loan to improve credit score, reported to major credit bureaus |

| Identity Theft Protection | Up to $1 million reimbursement, restoration services, lost wallet assistance |

| Budgeting Tools | Finance Helper for spending monitoring, bill reminders |

| Gig Finder Tool | Connects users with side gigs, jobs, surveys, and offers cash-back rewards or discounts |

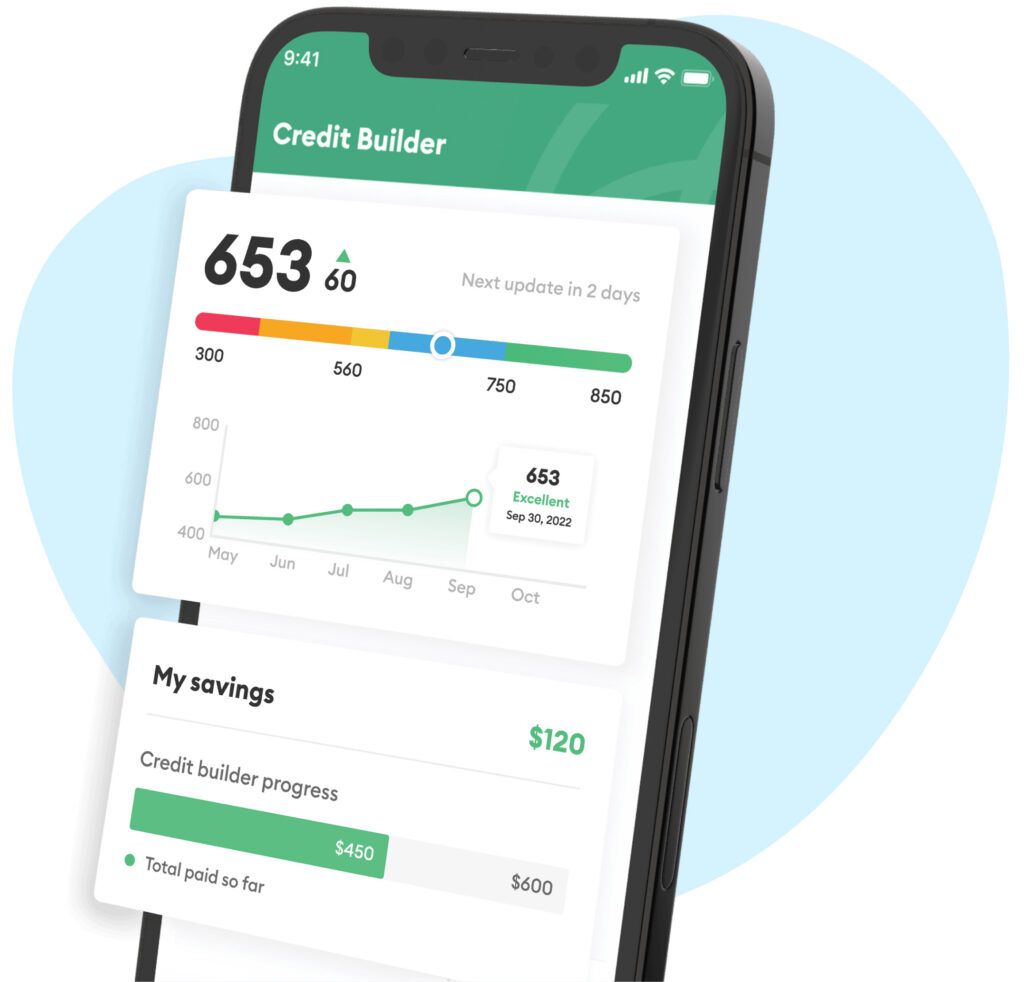

Brigit Credit Builder

Brigit’s Premium plan, priced at $14.99 per month, includes credit-building services. Premium members can take advantage of the Credit Builder account, which features an interest-free credit-builder Brigit loan.

Brigit’s credit-builder loan is designed to help individuals with no or poor credit increase their credit score. It works like this: Brigit holds a predetermined amount of money in a secured deposit account. Each month, you make monthly payments of at least $1 and Brigid reports the activity to the three major credit bureaus. Once the loan is paid off, the funds are released back to you.

Identity Theft Protection

Both of Brigit’s paid plans include identity theft protection. Benefits include up to $1 million for identity theft reimbursement, restoration services, and lost wallet assistance.

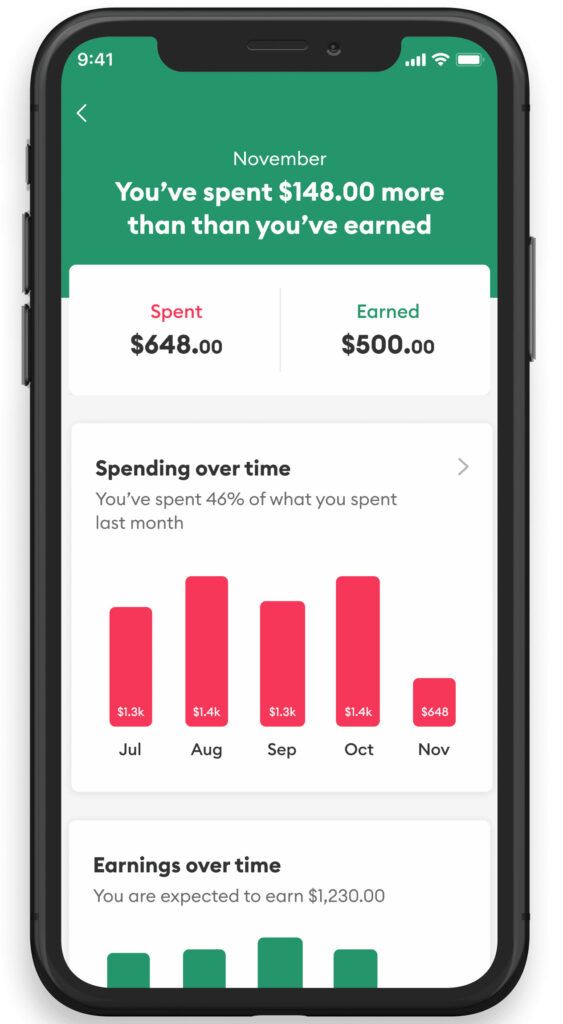

Budgeting Help & Financial Insights

The Brigit app includes a Finance Helper feature that helps individuals monitor their spending habits and earnings through forecasts and breakdowns. It also allows users to set up reminders for upcoming bills. Users do not have to pay for a monthly plan to access Brigit’s budgeting tools.

Gig Finder Tool

Brigit’s free Earn & Save feature helps connect users with new opportunities for earning money. These include side gigs, full or part-time jobs, and ways to make money from home. The feature also gives users exclusive offers from partners such as cash-back rewards or discounts.

How Much Does Brigit Cost?

Brigit starts at $9.99 for the Plus plan, which is required to unlock cash advances. With Brigit Plus, users also get identity theft protection, credit monitoring, budgeting tools, and a side gig finder. For $14.99 per month, members can also upgrade to Brigit Premium to use the app’s credit-building services.

| Plan | Cost | Features |

|---|---|---|

| Free | $0 | Budgeting tools, side hustle finder |

| Brigit Plus | $9.99/month | Cash advances, identity theft protection, credit monitoring |

| Brigit Premium | $14.99/month | All Plus features, credit-building services, free same-day Express Delivery |

Aside from the monthly membership fee, a Brigit cash advance does not have any other mandatory fees. There is no interest charged, late fees, or penalty fees. Premium members also get free same-day Express Delivery for cash advances, but Plus members must pay an extra fee of $0.99 to $3.99 if they want to get their money instantly.

Additionally, if you don’t want cash advances or credit-building tools, Brigit does have a free version of the app. The free app still includes budgeting tools and a side hustle finder.

The Best Ways To Save Money At Home.

Is Brigit Safe?

Brigit is a legitimate and safe app that uses bank-level encryption to protect user’s money and personal data. That said, the company landed in hot water with the FTC for deceptive advertisements that promised instant cash advances up to $250 with no hidden fees. The FTC’s claim said that Brigit misled consumers because there is an extra fee for same-day transfers, and a monthly subscription is required to access cash advances.

Furthermore, the FTC alleged that Brigit made it easy to sign up but difficult to cancel paid subscriptions. In November of 2023, Brigit settled the complaint by re-working its advertising and paying out $18 million in customer refunds.

How Does Brigit Work?

Follow these steps to get started with Brigit:

- Download the Brigit app and create an account. You can download Brigit for free on the Apple App Store or Google Play. Then, sign up and connect your bank account. You will need to sign up for Brigit’s Plus or Premium plan to access cash advances.

- Find out if you’re eligible for a Brigit cash advance. Brigit will review your bank account activity and give you a score between 0-100. Your score must be at least 40 to qualify for a Brigit cash advance and will also be used to determine how much you’re allowed to borrow.

- Request a Brigit cash advance. Select the amount you’d like to borrow and request a cash advance. Brigit will send you money in 1-3 business days; or, you can pay extra for Express Delivery in under 20 minutes.

- Repay your advance. Two days before your settlement date, which is typically your next pay day, Brigit will send you a notification. You can also choose to pay it back before your due date. Brigit automatically withdraws money in the amount of your advance on your repayment date. If you are unable to pay it back, you can request an extension. But, you must make an extension request by 3 PM ET the day before your repayment is due for it to be approved.

Who Is Brigit Best For?

Apps like Brigit are best for people who receive consistent income and occasionally need a bit of extra cash to bridge the gap to their next payday. When emergencies hit, an interest-free Brigit cash advance is a much better solution than traditional, exploitative payday loans or taking out debt with high interest rates.

The Brigit app might also be useful to help avoid bank account overdrafts. The auto-advance feature will automatically deposit money into your account if it senses that you are about to overdraw, protecting you from potential overdraft fees.

Along with cash advances, the Brigit app also includes helpful budgeting and credit-building tools. However, it’s not designed as a long-term solution for money problems or those without a regular paycheck.

Additionally, Brigit offers a lower cash advance limit compared to competitors like EarnIn and Dave, and it charges high fees for instant advances along with a monthly subscription fee. The app has also gotten into trouble with the FTC due to its confusing fee structure.

Other Brigit App Reviews From Customers

Brigit has largely positive reviews, with a 4.4 out of 5 star rating on Trustpilot out of 308 reviews, and a 3.49 out of 5 star rating on Better Business Bureau across 226 reviews.

| Platform | Rating | Number of Reviews |

|---|---|---|

| Trustpilot | 4.4/5 stars | 308 |

| BBB | 3.5/5 stars | 226 |

| Apple App Store | 4.8/5 stars | Over 290 |

| Google Play | 4.7/5 stars | Over 190,000 |

Satisfied users praise the app for being helpful and affordable. Customers also describe the cash advance process as being easy and quick.

However, there are a few complaints about confusing fees, trouble closing accounts, and the credit-builder Brigit loan.

Brigit Customer Service

Brigit offers customer service through a chatbot on the HelloBrigit website or in-app chat. There’s also a useful HelloBrigit Help Center with answers to FAQs and solutions to common issues.

Alternatively, users can also contact Brigit customer service through email at info@hellobrigit.com. Most emails are responded to in less than 24 hours. Brigit does not have a customer service phone number.

Is Brigit Worth It?

If you’re in a financial bind, Brigit can help you make it to your next payday. A Brigit cash advance lets you take out up to $250 – interest-free and with no credit check. It provides a superior alternative to predatory payday loans or high-interest debt.

The Brigit app also includes plenty of other useful features to help you budget and increase your credit score. If you’re seeking a cash advance app along with some budgeting or credit-building assistance, Brigit might be worth paying the monthly subscription fee.

However, if you are solely interested in free cash advances, we recommend using apps like Cleo, EarnIn or Dave, which offer larger cash advances for little to no cost.

Does Brigit impact my credit score?

No, Brigit does not report your cash advance repayment activity. If for some reason, you fail to settle your balance on time, your credit score remains unaffected.

That said, to help boost your credit score, Brigit does report Credit Builder account activity to the three major credit bureaus: TransUnion, Experian, and Equifax. Some users have reported this having the opposite effect, however, if they fail to make a credit-builder loan payment.

How long does it take to get money from Brigit?

Standard Brigit cash advance transfers take 1-3 business days to hit your account. However, you can pay extra for Express Delivery to get your money within 20 minutes after you request an advance.