Apps Like MoneyLion

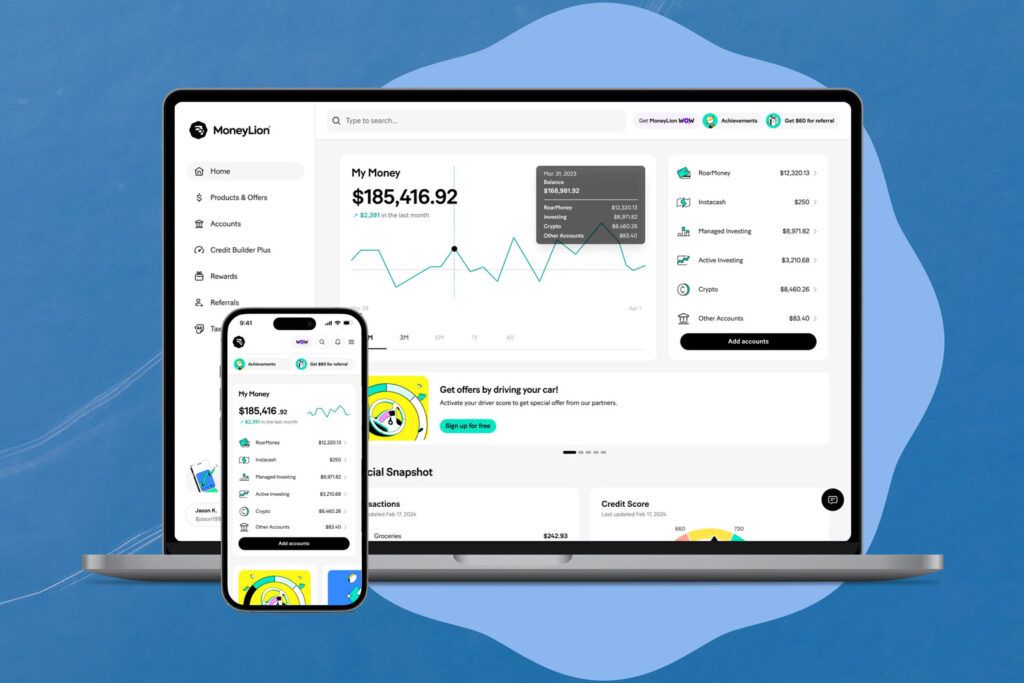

If you’re in a financial bind, it’s reassuring to know that there are cash apps available to help you access quick funds. Apps like MoneyLion let you borrow against your next paycheck, providing a fast cash boost without credit checks or interest charges.

Although MoneyLion Instacash is one of the best cash advance apps offering up to $500 (or $1000 if you have a MoneyRoar account), it’s best suited for current MoneyLion users. If you don’t have an account with them already, then you may want to take a look at these MoneyLion alternatives instead.

Apps Like MoneyLion

| App | Loan Amount (per pay period) | Fees | Deposit Speed | Special Features |

|---|---|---|---|---|

| MoneyLion | Up to $500 ($1000 with MoneyRoar) | No fees | 1-3 business days | No credit checks or interest |

| EarnIn | Up to $750 | Optional tips, $3.99-$4.99 Fast-Advance fee | 1-3 business days | High cash advance limits |

| Chime | Up to $500 | $2 Fast Advance | 1-3 business days | Early access to paychecks |

| Dave | Up to $500 | $1 monthly, $3-$25 Fast Advance | 1-3 business days | Budgeting tools, side hustle finder |

| Brigit | Up to $250 | $8.99-$14.99 monthly, $0.99-$3.99 Fast Advance | 1-3 business days | Credit score monitoring, identity theft protection |

| Empower | Up to $300 | $8 monthly, $1-$8 Fast Advance | 1-5 business days | Automatic savings, credit-building |

| Cleo | Up to $250 | $5.99-$14.99 monthly, $3.99 Fast Advance | 3-4 business days | Financial advice AI assistant |

| Possible Finance | Up to $500 | $15-$20 per $100 borrowed | 1-2 business days | Short-term personal loans |

| Branch | Up to 50% of wages | Optional tips, $2.99-$4.99 Fast Advance | Instant to 3 days | Employer-sponsored, instant transfers |

| Albert | Up to $250 | $14.99 monthly, $4.99 Fast Advance | 2-3 business days | Real financial experts, budgeting and investing tools |

1. EarnIn

Similar to MoneyLion, EarnIn is a free app that offers cash advances to qualifying individuals, with a generous limit of up to $750 every pay period. However, daily withdrawals are capped at $100, so you may need to make multiple withdrawals over several days to access the full amount.

👍

Pros

- Free to use

- High cash advance limits

- Low express transfer fees

👎

Cons

- Requires proof of employment

- $100 daily limit

Loan Amount: up to $750 per pay period

Fees: Optional tips up to $13, $3.99-$4.99 Fast-Advance fee

Deposit Speed: 1-3 business days

EarnIn also has stricter income requirements than MoneyLion. It does not accept self-employment, gig work, or unemployment benefits as valid sources of income.

2. Chime

Chime is a money app with two features that can help you access funds before payday: Chime SpotMe and Chime MyPay. SpotMe provides overdraft protection up to $200 while the newly-introduced MyPay feature offers traditional cash advances up to $500 each pay period.

👍

Pros

- No monthly subscription

- Few income eligibility requirements

- Offers additional banking features

👎

Cons

- Must have Chime checking account

- Starting advance limit could be as low as $20

Loan Amount: up to $500 per pay period

Fees: $2 Fast Advance

Deposit Speed: 1-3 business days

Similar to MoneyLion, Chime has minimal income requirements and offers additional banking features, like early access to paychecks and a credit-building tool. However, you do have to sign up for a Chime checking account to access their overdraft protection and cash advance features.

3. Dave

Another MoneyLion alternative is Dave, a cash advance app that lets you borrow up to $500 every pay period. While it isn’t free, the monthly membership fee is just $1. Dave also has some of the easiest repayment terms on this list, allowing for date extensions.

👍

Pros

- High cash advance limit

- Flexible repayment terms

- Does not require a minimum balance

👎

Cons

- Expensive same-day transfer fees

- Requires monthly subscription

Loan Amount: up to $500 per pay period

Fees: $1 monthly membership, $3-$25 Fast Advance, optional tip up to 25% of advance amount

Deposit Speed: 1-3 business days

In addition to cash advances, Dave users also get access to budgeting tools and a side gig finder. Similar to MoneyLion, users can pay an express transfer fee if they don’t want to wait the standard one to three business days to receive their funds. However, Dave’s fast-advance fees can be pricey, ranging from $3-$25, depending on the advance amount.

4. Brigit

Brigit is a money app for people with no or low credit scores, offering a suite of tools to help them improve their financial health. Among its features is Instant Cash, which offers cash advances of up to $250. Brigit also provides budgeting tools, credit score monitoring, identity theft protection, and a side hustle finder.

👍

Pros

- Includes budgeting tools

- Can help build your credit score

- Brigit Premium members get discounts

👎

Cons

- Pricey monthly subscription

- Low cash advance limit

- Must wait 60 days before you can request an advance

Loan Amount: up to $250

Fees: $8.99 or $14.99 monthly subscription, $0.99-$3.99 Fast Advance

Deposit Speed: 1-3 business days

To access Instant Cash, you must pay $8.99 per month for Brigit Plus. For credit-building tools, you also have the option to upgrade to Brigit Premium for $14.99 per month.

5. Empower

Empower is another cash advance app that offers $10 to $300 per pay period. The average advance amount is $145. Similar to MoneyLion, Empower also has other financial tools, like automatic savings, credit-building, and budgeting assistance.

👍

Pros

- Advances typically deposited within one business day

- Features budgeting assistance and credit-building tool

- Includes 14-day free trial

👎

Cons

- Starting cash advance limit can be as low as $10

- Requires monthly membership fee

Loan Amount: up to $300 per pay period

Fees: $8 monthly subscription, $1-$8 Fast Advance

Deposit Speed: 1-5 business days

The app costs $8 per month, and one of its main advantages is that most advances are deposited within one business day at no extra charge. However, depending on your bank, it can take up to five business days unless you opt to pay a fast advance fee.

6. Cleo

Cleo is a unique MoneyLion alternative that offers cash advances up to $250. The app is best known for its snarky AI assistant, which delivers helpful financial advice in the form of “roasts.” Overall, Cleo aims to help people save more money at home and also lets you borrow money.

👍

Pros

- Does not require proof of employment

- Freelancers and gig workers qualify

- Sarcastic AI assistant can be fun

👎

Cons

- Requires monthly subscription

- Cash advance limit maxes out at $250

Loan Amount: up to $250

Fees: $5.99-$14.99 monthly subscription, $3.99 Fast Advance

Deposit Speed: 3-4 business days

Similar to MoneyLion, Cleo cash advances are accessible to freelancers and gig workers. You do not need to provide proof of employment to qualify. However, to access the cash advance feature, you need to subscribe to Cleo Plus for $5.99 per month. You can also upgrade to a Cleo Credit Builder plan for $14.99 per month.

7. Possible Finance

Unlike other apps like MoneyLion InstaCash, Possible Finance is not a cash advance app. Instead, it’s a lending app that offers short-term personal loans up to $500 for people with low or no credit scores. Loans must be paid back within a 2-month time period, which is much longer than most cash advance apps or payday loans.

👍

Pros

- Offers loans that can help build your credit score

- Does not charge late fees

- Lengthy repayment terms

👎

Cons

- High fees

- Can adversely impact your credit score

Loan Amount: up to $500

Fees: $15-$20 per every $100 borrowed, or 25% of the loan amount (varies by state)

Deposit Speed: 1-2 business days

There are no late fees if you fail to make a repayment on time; however, Possible Finance does report payment activity to two of the three major credit bureaus. This can help build your credit score, but can also adversely impact it if you miss payments.

A Possible Finance loan is also more expensive than a cash advance, with fees ranging from $15 to $20 per $100 borrowed or up to $15% of the loan, varying by state.

Get started with Possible Finance!

8. Branch

Branch is an app that provides early access to your earned wages. You can take out up to 50% of your upcoming paycheck, up to $1,000.

👍

Pros

- Can get up to 50% of your pay early

- No mandatory fees

- Instant transfers to digital wallet

👎

Cons

- Employer must have direct partnership with Branch

- Transfers to bank account can take 3 days

Loan Amount: up to 50% of your wages

Fees: Optional tips, $2.99 to $4.99 Fast Advance

Deposit Speed: Instant to digital wallet or up to 3 business days to bank account

However, not everyone has access to Branch. The app is employer-sponsored, which means that your employer has to work directly with Branch for you to use its service. You cannot set up your own account. You must also have two consecutive months of direct deposits from that same employer in order to qualify.

9. Albert

Albert strives to be the Swiss Army knife of financial apps, offering cash advances up to $250 along with a suite of additional features. To access most of these features, including cash advances, you have to subscribe to Albert Genius for $14.99 per month.

Loan Amount: up to $250 per pay period

Fees: $14.99 monthly subscription, $4.99 Fast Advance

Deposit Speed: 2-3 business days

👍

Pros

- All-in-one financial app

- Can get advice from financial “geniuses”

- 30-day free trial

👎

Cons

- Low cash advance limit

- Expensive monthly subscription

Albert Genius uniquely provides access to real financial experts, called “Geniuses,” whom you can chat with to get tailored financial guidance. A Genius subscription also includes budgeting and investing tools, a cash account, and recurring savings.

Read the full Albert review to learn more >>

What Are Some Other Alternatives To Consider?

Apps like MoneyLion provide a convenient way to cover unexpected bills or emergencies, but they aren’t a long-term solution for ongoing money issues and they may not be suitable for everyone.

Some people, like those on unemployment benefits, may not qualify for a cash advance. Others might need a higher borrowing limit or longer repayment terms than cash advances offer. If this is the case for you, you may want to consider these alternatives:

- Starting a side hustle

- Driving for a ride-sharing app like Uber or Lyft

- Delivering food for a gig economy app like DoorDash

- Personal loans

- Credit card usage

- Asking family and friends

Though a payday loan may sound tempting, we strongly recommend against it. Payday loans often have predatory terms and high interest rates, which can lead to you getting trapped in a cycle of debt. With so many other options out there to help you out on a rainy day, payday loans pose too much of a risk.

The Best Personal Finance Software To Use.

Final Thoughts

If you need some extra funds to hold you over until your next payday, there are many apps that can help. MoneyLion Instacash is one of the best cash advance apps out there, but it’s definitely not the only choice you have.

Depending on your financial situation, a different cash advance app may be a better option. Before signing up for any of these cash advance apps like MoneyLion Instacash, take time to consider factors like fees, eligibility requirements, and limits to determine which is the best choice for you.

Want more nifty money-saving guides? Checkout: